📝 Carta's VC Report: A Wake-Up Call for the Industry

Let's get a bit of context else it is just alarmist

Carta's latest VC Fund Performance report paints a grim picture of the venture capital sector, highlighting significant underperformance. However, while the report is detailed and informative, it misses two critical points that make its conclusions potentially misleading and even damaging to the industry. First, it downplays the importance of the J curve—a fundamental concept in venture capital that explains why early-stage funds typically show low or negative returns. Second, it relies on misaligned time series comparisons that fail to account for the varying stages of fund lifecycles, leading to skewed conclusions.

These oversights mean that while the report uncovers some concerning trends, these findings must be viewed through a more accurate and nuanced lens. Yes, there is room for improvement in the VC industry, but the real challenge lies not just in refining analysis but in embracing a more sophisticated approach to venture capital management.

This shift is essential to navigating the complexities of today’s market environment and ensuring long-term success.

What is covered:

🔍 1. The J Curve: A Fundamental Concept in Private Markets

🔍 2. Case Study: Benchmark's Investment in eBay

🔎 3. Misaligned Comparisons: Skewing the Data

Slow Capital Deployment:

✅ Strategic InsightDeclining Startup Graduation Rates:

✅ Strategic InsightLow Distribution to LPs:

✅ Strategic InsightNegative IRRs:

✅ Strategic InsightUnderwhelming Fund Performance:

✅ Strategic Insight

📈 4. Comparative Analysis with the S&P 500: A Stark Contrast

🕵️ 5. Potential Motivations Behind the Report

🚀 6. Moving Forward: Time for VCs to Up Their Game

💻 A Data-Driven Approach for the Startup Investment Ecosystem series

🧠 7. Embracing a Sophisticated Management Approach

🔍 1. The J Curve: A Fundamental Concept in Private Markets

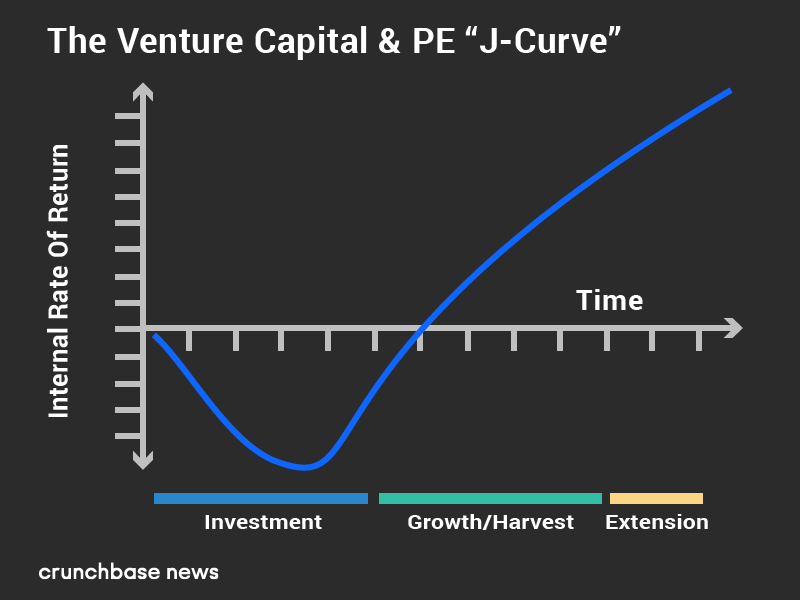

The J Curve is not just a venture capital concept—it’s a fundamental economic principle observed across all private markets, including private equity, real estate, and infrastructure investments. The curve illustrates how returns often start in negative or flat territory due to the initial costs of investments and the time required for assets to mature and generate returns. This pattern is common in any scenario where significant upfront investment is needed before returns can be realised.

In the context of venture capital, the J Curve explains why early-stage funds typically show low or negative returns. Initial investments are used to build and scale startups, which often require several years to generate substantial revenues or achieve exits. As these companies grow and succeed, the returns increase, pushing the curve upward.

The Carta report acknowledges the existence of the J Curve but fails to give it the weight it deserves in evaluating fund performance. By critiquing funds still in the early, negative phase of their J Curve, the report potentially misleads readers into thinking these funds are underperforming. In reality, these funds are following a natural, expected trajectory common to all private market investments. Without fully accounting for the J Curve, the report’s conclusions lack the necessary context and risk distorting the true picture of how these funds are performing.

After discussing the theoretical aspects of the J-Curve and its implications for venture capital investments, let’s examine a real-world application of this concept. One illustrative example is Benchmark's investment in eBay. This case not only demonstrates the typical progression of the J-Curve but also highlights the critical role of strategic guidance and patient capital in realising long-term gains from venture capital investments.

2. Case Study: Benchmark's Investment in eBay

Overview:

In 1997, Benchmark Capital invested $6.7 million in eBay, then a relatively unknown online auction site. This investment was a critical moment not only for eBay but also for Benchmark, representing a significant gamble on the burgeoning internet commerce sector. The venture promised vast potential but also carried substantial risk, epitomizing the early stages of a typical venture capital investment.

The J-Curve Effect:

Initially, eBay, like many startups, faced numerous challenges, including scaling its infrastructure and securing a reliable revenue model. This period of significant investment and low returns is characteristic of the initial downward phase of the J-Curve in venture capital investments. However, eBay quickly began to show promise as it captured the growing enthusiasm for online shopping, leading to a rapid increase in user base and, subsequently, revenues.

Strategic Guidance and Patient Capital:

Benchmark provided not just financial backing but also strategic guidance to eBay, helping steer the company through critical growth phases. This included nurturing leadership, refining the business model, and navigating regulatory landscapes—key roles that venture capitalists play beyond mere financing. Benchmark's patient capital and active management were instrumental as eBay moved past its initial teething phase into a period of explosive growth.

Substantial Long-Term Gains:

The initial $6.7 million investment by Benchmark grew exponentially as eBay became a dominant player in online retail. When eBay went public in 1998, its market value soared, significantly benefiting Benchmark and its investors. This turnaround from slow initial growth to substantial returns exemplifies the upward swing of the J-Curve, where early-stage investments mature into lucrative exits.

To ensure a fair and meaningful comparison of venture capital funds across different vintage years, it's crucial to analyse each fund's performance at a consistent lifecycle stage. This approach accounts for the J-curve effect and provides a more accurate reflection of each fund's strategic decisions over time and also systemic, macro and micro events.

Higher Median IRR in Earlier Vintages: The 2017 and 2018 vintages show higher median IRRs, benefiting from earlier strong market conditions. However, recent performance has declined due to market corrections.

Recent Performance Decline: The 2019 and 2020 vintages, initially strong, have seen their IRRs drop significantly in recent quarters, reflecting the broader market downturn.

Comparison with Newer Vintages: The 2021 and 2022 vintages started with negative IRRs but seem more stable now, as they've already faced significant market volatility.

Key Takeaway: While earlier vintages benefited from a market bubble, they've since declined. Newer vintages, starting from a lower base, might offer more stability moving forward.

🔎 2. Misaligned Comparisons: Skewing the Data

The report compounds its issues by comparing different vintage years as if they’re at the same stage in their lifecycle. For instance, comparing the five-year performance of a 2017 fund with the three-year performance of a 2021 fund is like comparing a fully grown tree with a sapling—they’re at entirely different stages of growth. This misalignment distorts the reality of how VC funds develop over time and can lead to misleading conclusions about the current state of the market.

To get a true picture, it’s essential to analyze each fund’s performance at consistent lifecycle stages, considering both the J-curve effect and the broader market conditions. This is not just about improving the accuracy of analysis but about making informed, strategic decisions that drive better management practices and outcomes.

While the report is flawed, it does uncover some trends that warrant attention. However, these findings must be interpreted with an understanding of the J curve and the lifecycle of VC funds.

Slow Capital Deployment: The 2022 vintage funds have deployed only 43% of their committed capital at the 24-month mark. This measured approach may be strategic, reflecting caution in a volatile economic climate influenced by the end of ZIRP, rapid interest rate hikes, geopolitical tensions, and AI disruptions. By pacing their investments, VCs aim to ensure that funds are allocated to ventures that are resilient and poised for growth in a rapidly changing world.

✅ Strategic Insight: This cautious capital deployment positions VCs to capitalise on the most promising opportunities, ensuring smarter, more resilient investments.

Declining Startup Graduation Rates: A sharp decline in startups graduating from seed to Series A funding has been observed, with only 15.4% of the 2022 cohort advancing compared to 30.6% of the 2018 cohort. It's crucial to note that the 2018 rate was significantly higher than the typical 20-25% range, making the 2022 figure appear more aligned with historical norms under current challenging conditions.

✅ Market Adjustment: The 2022 graduation rate reflects a reversion to typical industry conditions, necessitating enhanced support and resources for early-stage companies to aid their growth.

Low Distribution to LPs: Less than 10% of the 2021 vintage funds have returned capital to limited partners after three years, a statistic that might initially alarm investors. However, this aligns with the early lifecycle stage of these funds, where capital is still being actively deployed and not yet returning gains.

✅ Industry Norms: The current low distribution levels are typical for funds at this stage, with expectations for returns to increase as investments mature and reach exit stages.

Negative IRRs: More recent fund vintages, starting around 2017, have reported negative IRRs, raising concerns about the effectiveness of current VC strategies. This trend is in line with the J-curve effect, where initial high costs and investments may not yield immediate returns.

✅ Expected Trajectory: These negative IRRs reflect the typical early stages of venture capital investments where expenses initially outpace gains. It underscores the necessity for VCs to adapt and refine strategies, especially in a market that demands agility and strategic foresight.

Underwhelming Fund Performance: The report points out that key performance metrics such as Total Value to Paid-In (TVPI) and Distribution to Paid-In (DPI) remain low for recent vintages, often falling below 1x. This indicates that the total value of these funds, encompassing both unrealized and realized gains, is less than the capital initially invested by LPs. While this may raise concerns at first glance, it's crucial to understand that these metrics are reflective of the funds' early lifecycle stages.

✅ Contextual Norms: The lower TVPI and DPI are consistent with industry norms for early-stage funds, where initial investments are still maturing. Although these figures may appear disappointing, they align with the typical early performance trajectory in venture capital, where significant returns materialise later as investments reach maturity and exit stages.

📈 4. Comparative Analysis with the S&P 500: A Stark Contrast

While the Carta report itself does not directly compare VC performance to the S&P 500, the manner in which VC funds' performances are presented can lead asset allocators to make such comparisons themselves. The misalignment in time series comparisons, such as juxtaposing short-term results from VC funds against long-term gains from the S&P 500, can draw misleading conclusions. The S&P 500’s performance, showing a total return of approximately 184% from 2017 to 2024, underscores consistent returns and superior liquidity. When asset allocators use this data and benchmark it, the illiquid and long-term nature of VC investments may appear underwhelming by comparison because the data does not show the full picture.

This is problematic as it overlooks the fundamental investment strategy of VCs, which focuses on long-term, substantial returns that take time to materialise.

🕵️ 5. Potential Motivations Behind the Report

Some might speculate that the framing of the report could be influenced by larger firms aiming to acquire emerging managers at a discount. If true, this would allow these dominant players to expand their assets under management by absorbing smaller, seemingly underperforming firms at lower costs. This possibility, while speculative, suggests deeper strategic manoeuvres within the venture capital industry.

🚀 6. Moving Forward: Time for VCs to Up Their Game

The Carta report, while revealing some concerning trends, acts as a critical wake-up call for the venture capital industry. It emphasises the urgent need for VCs to evolve from traditional, subjective investment methods to more analytical and strategic approaches in response to today's complex and volatile market environment.

Enhanced Deal Sourcing and Investment Evaluation: Transitioning from instinct-based decisions to data-driven ones is crucial. VCs should utilise advanced analytics and machine learning to uncover patterns and insights that yield a more accurate assessment of a startup's potential, thereby facilitating better investment decisions.

✅ Strategic Insight: Leveraging data allows VCs to make informed decisions that are less prone to bias and more likely to succeed.

Strategic Development and Nurturing of Investments: Beyond financial support, VCs must play an active role in guiding their portfolio companies. This includes identifying strategic M&A opportunities, fostering synergies within the portfolio, and crafting partnerships that bolster growth and value.

✅ Active Management: Engaged and strategic management helps companies navigate growth challenges more effectively, enhancing potential returns.

Realisation Stage: Maximising Returns Through Strategic Exits: VCs need to be adaptable in their exit strategies, aligning them with ongoing market conditions and potential buyer interests. A proactive, continuous assessment and readiness to pivot are essential for maximising returns.

✅ Dynamic Strategies: Flexibility in exit strategies ensures that VCs can capitalise on market conditions to secure the best possible outcomes.

Implementing a Holistic Strategic Management Approach: To successfully navigate these stages, VCs must adopt a comprehensive, integrated approach that employs data-driven methodologies throughout the investment lifecycle. This strategy creates a continuous improvement loop, enhancing decision-making and management practices, which leads to stronger, more resilient venture capital operations.

✅ Comprehensive Approach: A holistic strategy ensures all aspects of fund management are aligned and optimised for success.

From Echo Chamber to Data-Driven Decisions

💡 Rebuilding Trust Through Transparency

🌐 A look at Traditional VC Sourcing, the challenges and timeframes

⚡ The Impact of AI and Big Data on Venture Capital Sourcing Strategies

✨ Integrating Data Analytics into Venture Capital for Informed Decision-Making.

✨ Utilising Data-Driven Strategies to Navigate Venture Capital's Bias Challenge.

🧠 Embracing a Sophisticated Management Approach:

The imperative for VCs is clear: to thrive, a shift towards proactive, strategic, and data-driven management is essential. By smoothing out the J-curve and delivering consistent value, VCs can redefine effective venture capital management. Adopting these sophisticated strategies not only enhances financial returns but also drives innovation and contributes to broader economic growth, thereby strengthening both individual investments and the entrepreneurial ecosystem at large.

The venture capital industry needs the tools to rise to the challenge; now it’s time to build them.

Thank you for reading. If you liked it, share it with your friends, colleagues and everyone interested in the startup Investor ecosystem.

If you've got suggestions, an article, research, your tech stack, or a job listing you want featured, just let me know! I'm keen to include it in the upcoming edition.

Please let me know what you think of it, love a feedback loop 🙏🏼

🛑 Get a different job.

Subscribe below and follow me on LinkedIn or Twitter to never miss an update.