💲📉 Financials and Projections, for you first

This Is How to Write Your Pitch Deck. #017

Let’s start here… because it is how to make your life easier, by having what you are doing and achieving in one place it gives you the understanding and focus of what you need to be speaking / writing about. Numbers are the easiest way to understand what your story telling should be about rather than the fairly tales we often hear.

What’s covered:

🌟 What the pro’s say?

🧭 Navigating Investment Readiness

🔦 Your one source of truth is your guiding light

💬 VC Q&A

🤝 Building Investor Confidence

🧩 How to fit it all together

🖼️ The Slide

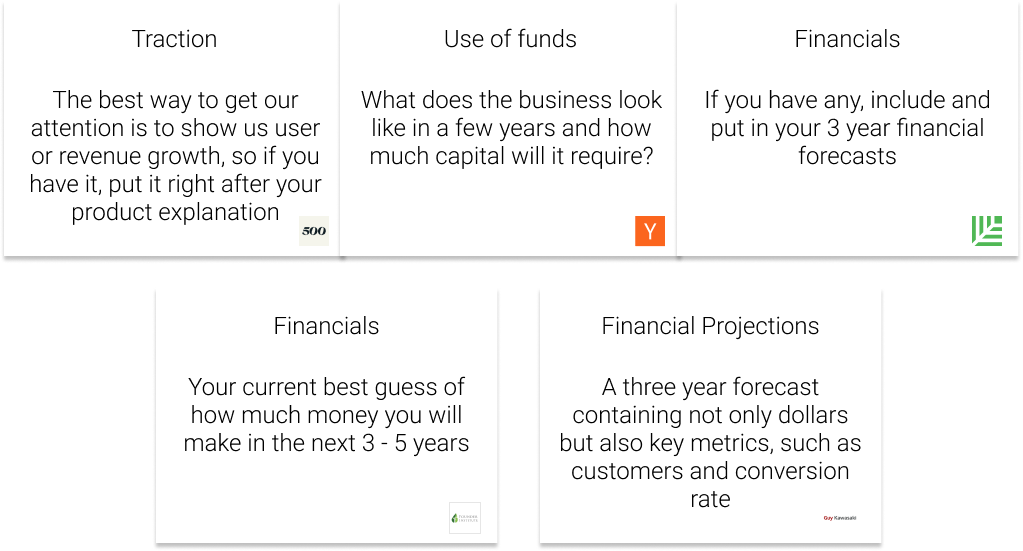

🌟 What the pro’s say?

While the required outputs are clear, understanding the inputs and their critical role in a startup's foundation is essential. A centralised system that consolidates all data into financial value and provides the ultimate source of truth is vital. This should not be seen as 'doing accounts' or 'bookkeeping,' but as the oracle of truth, where every aspect of the business is translated into financial insights—the ultimate reason any business exists.

🧭 Navigating Investment Readiness

Deciding what to put in and what to say can feel overwhelming. It's not just about avoiding the pitfalls of unrealistic growth projections and excessive spending. This slide is multifaceted, serving crucial purposes for all founders contemplating the investment route. The first question you need to tackle is, are you actually back-able? Answering this lays the foundation for your journey into the world of gaining investment from different investor types. Once you determine if you are venture back-able, the next step is understanding the requirements and expectations of follow-on funding rounds. Knowing where to focus at each stage is not just strategic; it's essential for guiding your startup's growth and aligning your aspirations with the realities of venture capital funding.

1. VC Back-ability and Stage-Specific Goals:

Understanding what investors / VCs look for at various funding stages is critical. Early on, they may focus on market potential and team capability, while later stages may demand clear paths to profitability and scaling. Your financial model should reflect these stage-specific expectations, showcasing your startup's potential to meet and exceed these benchmarks.