Part 4: The Vertical Economy. Hegemony doesn’t disappear — it migrates.

Why great powers rise or fall on their ability to control energy, compute, and industry in orbit — and why alliances fracture in the process.

📑 CONTENTS — PART IV

THE GEOPOLITICS OF A VERTICAL WORLD

Part III explained why the vertical economy becomes inevitable.

Part IV explains who wins it — and why the 20th-century powers are structurally unprepared for a 21st-century vertical order.

4.0 — The Great Rearrangement

Why the shift from horizontal to vertical breaks old alliances, invalidates 50 years of economic diplomacy, and redraws strategic power.

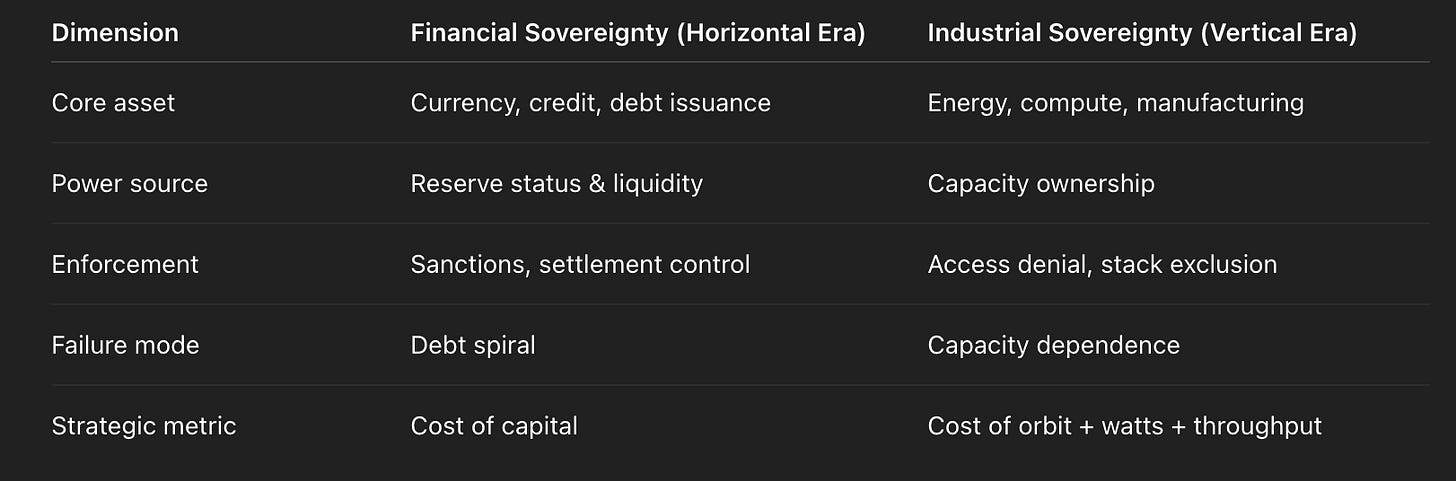

4.0.1 Industrial Sovereignty vs Financial Sovereignty

4.0.2 Why Vertical Capacity Becomes the New Reserve Currency

4.0.3 The First-Mover Advantage in Orbit

4.0.4 The New Map: Earth-States vs Orbit-States

4.1 — The United States: The Power That Must Pivot

A hegemon built on credit, consumption and military logistics forced to become a manufacturer again — without detonating its own asset markets.

4.1.1 The Dollar vs Orbital Energy

4.1.2 Reindustrialisation Without Inflation — The Impossible Puzzle

4.1.3 US Tech Giants as Proto-Orbit States

4.1.4 SpaceX as Strategic Infrastructure, Not a Company

4.1.5 Can the US Hold the High Ground Twice in One Century?

4.2 — China: The Production Empire That Saw This Coming

The only major power whose operating system already mirrors vertical logic.

4.2.1 From Belt-and-Road to Orbit-and-Node

4.2.2 Why China Is Built for Post-Scarcity Industrialism

4.2.3 State Capitalism Meets Off-World Manufacturing

4.2.4 The Demographic Trap — China’s Only Strategic Weakness

4.2.5 “Heavenly Manufacturing”: A Civilisational Framing

4.3 — Europe: The Civilisation That Forgot Power

The region least structurally prepared for a vertical economy — and the one most culturally uneasy with it.

But also the one holding the key: regulation, diplomacy, norms, energy grids.

4.3.1 Welfare States in an Age of Machine Labour

4.3.2 Germany: Export Imperialism Without the Empire

4.3.3 France: Strategic Imagination, Economic Restraint

4.3.4 Eastern Europe: Industrial Memory Without Industrial Scale

4.3.5 Can Europe Become the Ethical Architect of the Vertical Age?

4.4 — India: The Demographic Swing State

A billion-person labour engine entering the first age where labour is no longer scarce.

4.4.1 Why India’s Human Capital Paradox Is Perfect Timing

4.4.2 Indian Conglomerates as Off-World Partners

4.4.3 The Soft Power Advantage: Diaspora as Infrastructure

4.4.4 The Vacuum Left by China’s Ageing Curve

4.5 — The Gulf: The Energy Barons Become Compute Barons

From oil states to sovereign compute states — a transformation already underway.

4.5.1 From Petrodollar to “Petra-Compute”

4.5.2 Why the Gulf Can Build Orbital Infrastructure Faster Than the West

4.5.3 Sovereign AI, Sovereign Clouds, Sovereign Launch Capacity

4.5.4 The Rise of the Cislunar Energy Grid

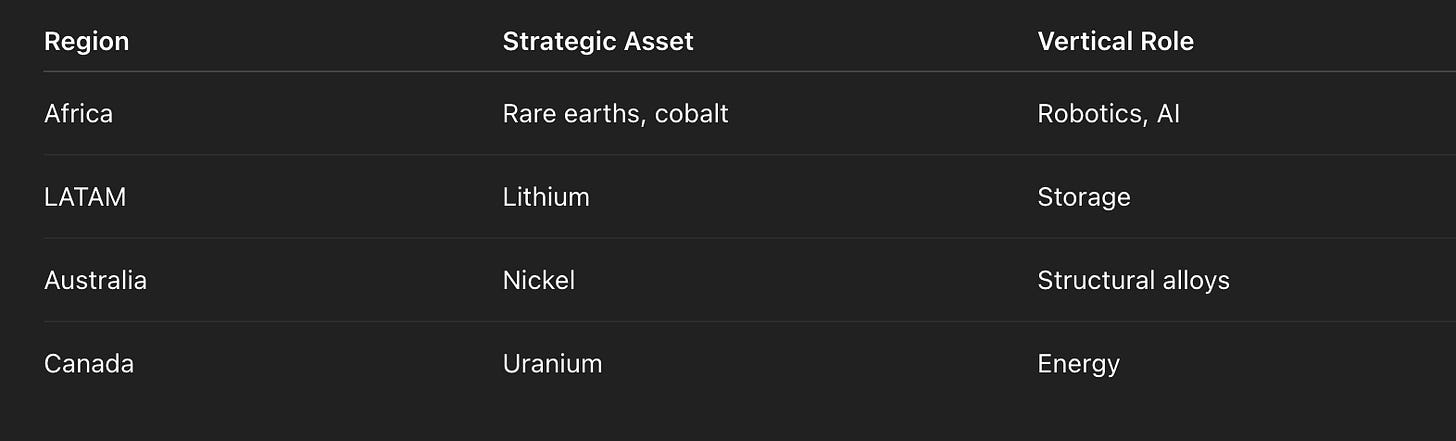

4.6 — Africa & Latin America: The Resource Powers Rediscovered

Verticalisation makes minerals strategic again — and both continents are resource kingdoms.

4.6.1 Why Gravity-Free Manufacturing Needs African Minerals

4.6.2 Brazil, Argentina and the New Lithium Hegemony

4.6.3 The Long Arc: “Those Who Hold the Minerals Hold the Orbit”

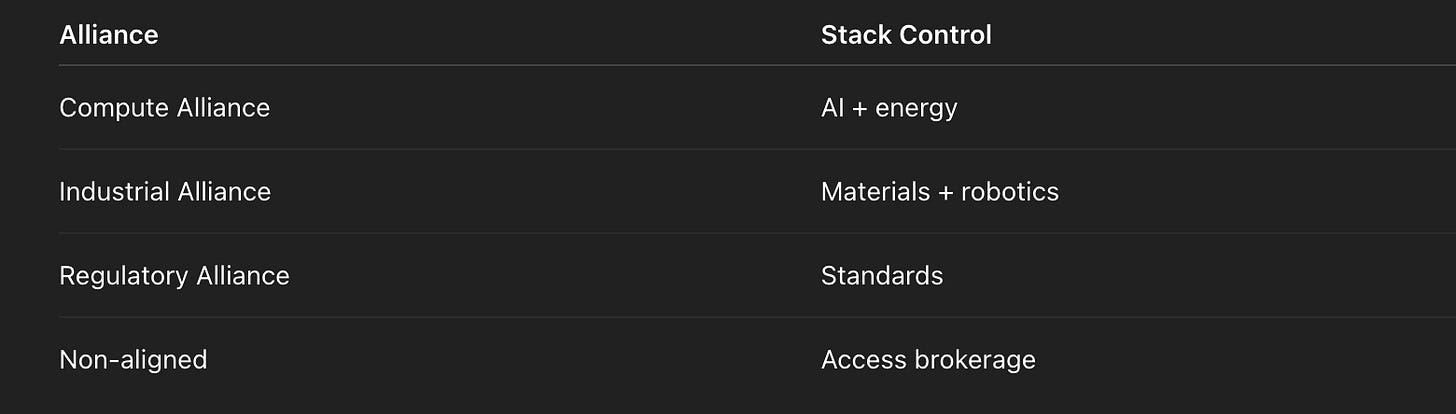

4.7 — The First Orbital Coalitions

New alliances that don’t look like NATO, BRICS, or the EU — but like supply chains.

4.7.1 The Compute Alliance (US + Gulf + East Asia)

4.7.2 The Industrial Alliance (China + BRICS Metals Belt)

4.7.3 The Regulatory Alliance (Europe + Japan)

4.7.4 The Non-Aligned Orbital Movement

4.7.5 Why Alliances Become Technical, Not Territorial

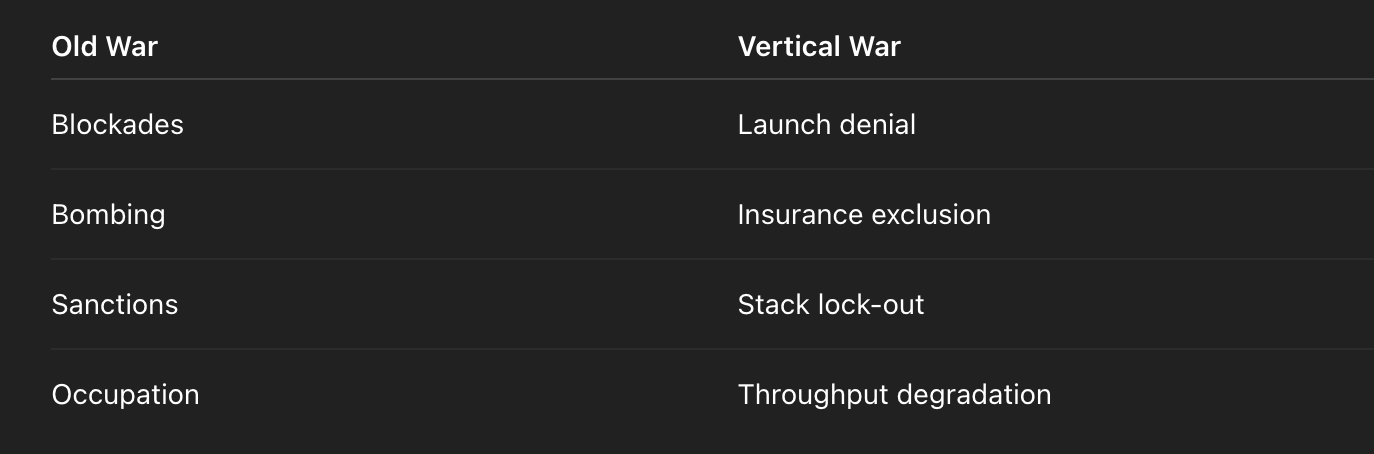

4.8 — War in a Vertical World

Not lasers in space — but economic enforcement.

4.8.1 Orbital Blockades, Not Naval Ones

4.8.2 Satellite Spoofing as the New Oil Embargo

4.8.3 The Weaponisation of Launch Capacity

4.8.4 The End of Mutually Assured Destruction?

4.9 — The Winners of the Vertical Economy

A sober, unsentimental conclusion.

4.9.1 The States With Capacity, Not Rhetoric

4.9.2 The Companies That Become Infrastructure

4.9.3 The AIs That Become Political Actors

4.9.4 Civilisations That Adapt — and Those That Don’t

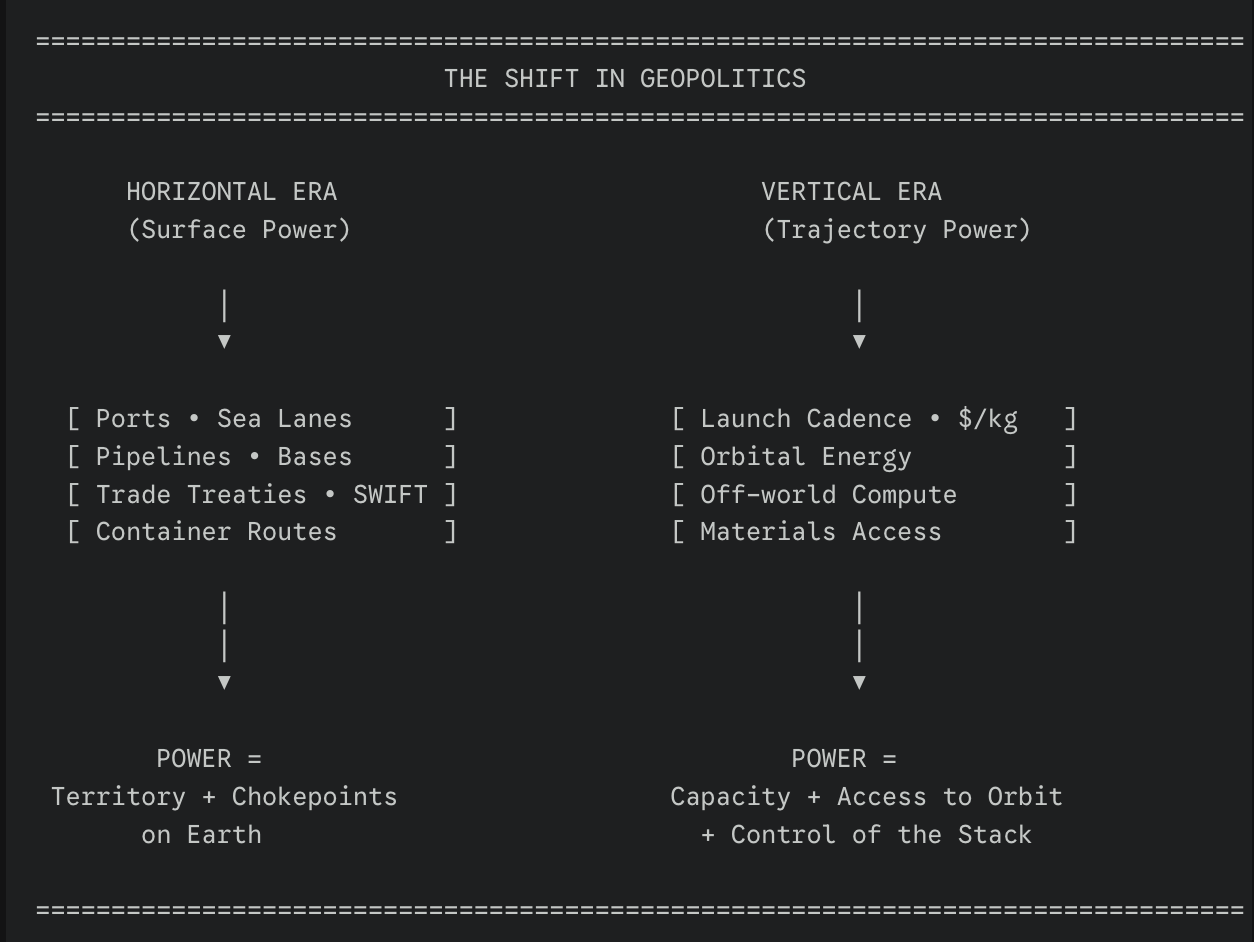

4.0 — The Geography of Power Breaks Its Map

Why the great-power system that dominated the last 70 years cannot survive the shift from horizontal to vertical industry.

Every era has a geography — a shape of power so obvious that people forget it is a choice.

For the second half of the 20th century, that geography was horizontal:

trade routes, shipping lanes, air corridors, pipelines, supply chains, bases, alliances.

Power was projected across the surface of the Earth because the economy lived there.

Manufacturing lived there.

Energy lived there.

Compute lived there.

Labour lived there.

Every strategic framework — NATO, OPEC, WTO, the dollar system, SWIFT, even the container ship — assumed one quiet constant:

the world economy was a terrestrial phenomenon.

Part III breaks that assumption.

When energy, compute, and industry begin to lift off the planet, the horizontal map stops explaining anything.

The rules that made America dominant, that kept Europe comfortable, that allowed China to industrialise at hyperspeed — all depended on a simple fact:

The ground was the only game.

It isn’t anymore.

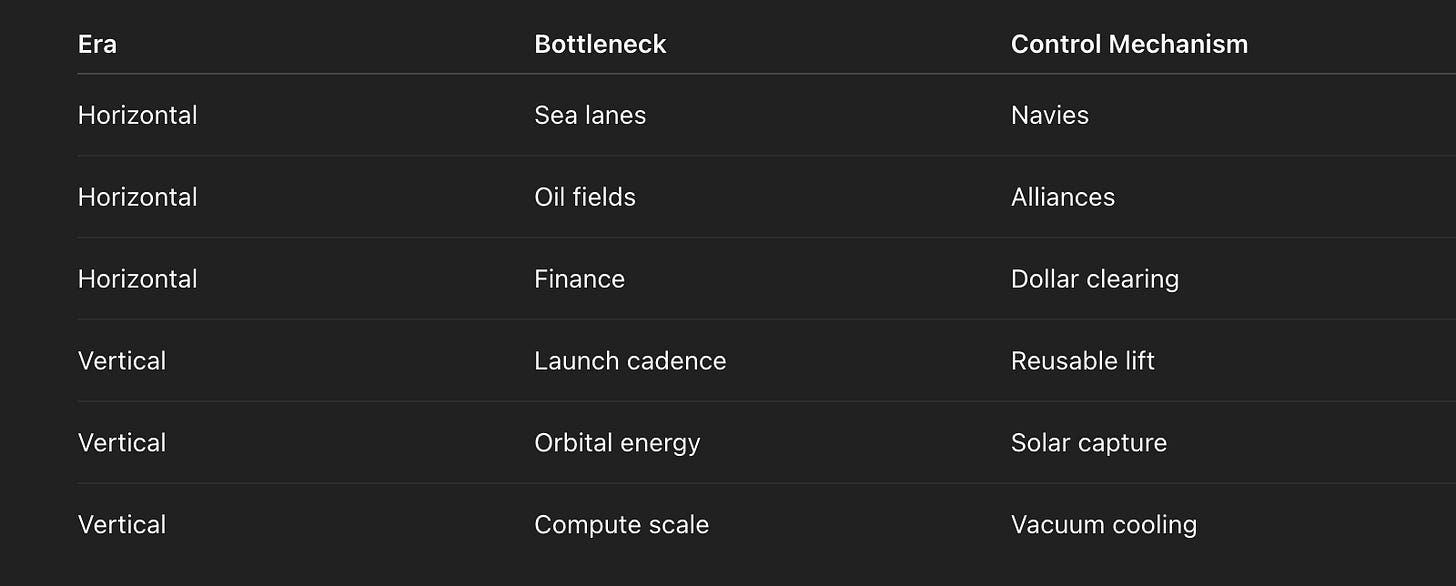

This is the moment power stops being a function of territory and becomes a function of trajectory — who can get mass to orbit cheapest, who controls the energy above the atmosphere, who commands the compute clusters not subject to terrestrial politics, and who builds the first industrial belt where gravity is optional.

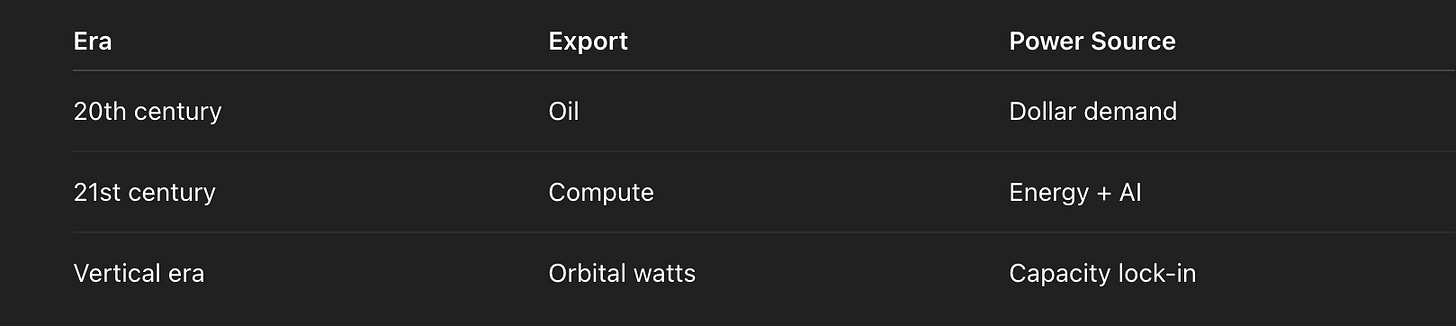

The 20th century was about land and sea.

The 21st pivots to orbit.

Not because politicians want it.

Not because futurists fantasise about it.

But because the economics force it.

The Impolite Truth of Part IV

This section makes one claim that most geopolitics avoids because it is inconvenient to every capital city:

Verticalisation collapses the old hierarchy of nations and elevates a new one.

Great powers are not great because of culture or destiny.

They are great because they sit atop a system whose physics reward them.

When the physics change, the hierarchy changes.

The United States dominated a world of oil, sea lanes and dollar clearing.

China rose in a world of manufacturing scale and labour arbitrage.

Europe thrived in a world where stability was valuable and demographics were supportive.

None of those worlds survive vertical industry.

And so Part IV asks the only strategic question that matters:

Who survives the shift from horizontal hegemony to vertical hegemony?

4.1 — The United States: The Last Horizontal Superpower

The empire built for a world that is disappearing.

The United States did not become a superpower through philosophy, culture, democracy, liberty, or any of the other polite myths it likes to export.

It became a superpower because the economic architecture of the late-20th century happened to align perfectly with the assets America already had:

control of the sea lanes

control of global finance

control of energy pricing

control of advanced aerospace

control of the world’s demand engine

America was the hegemon of a horizontal world — a civilisation optimised for trade routes, dollar liquidity, and the movement of goods across oceans.

Horizontal dominance made sense because the world economy existed on the surface of the Earth.

Part III showed why that won’t remain true.

Which leaves the US confronting a dilemma no empire ever wants:

The system it built continues to reward it — but the physics that sustained that system are evaporating.

The question is no longer “Can America remain dominant?”

It is “Can America migrate its dominance upward before the window closes?”

4.1.1 The World America Built — and Why It Worked

The US created the operating system of the post-war world:

Bretton Woods (global settlement)

Petrodollar (energy pricing)

NATO (security umbrella)

SWIFT (financial plumbing)

Container shipping (trade infrastructure)

Silicon Valley (technology stack)

This was not altruism.

America designed a world in which every major flow — energy, money, information, and goods — touched an American chokepoint.

Its genius was not central planning — it was accidental optimisation.

The US just happened to sit atop the three bottlenecks that defined horizontal power:

1. Sea lanes — the US Navy made globalisation physically possible.

2. Dollar liquidity — US deficits became everyone else’s savings.

3. Energy control — a Middle East ordered around American security.

No country in history has been so perfectly positioned for the rules of its era.

The trouble is: the era is changing.

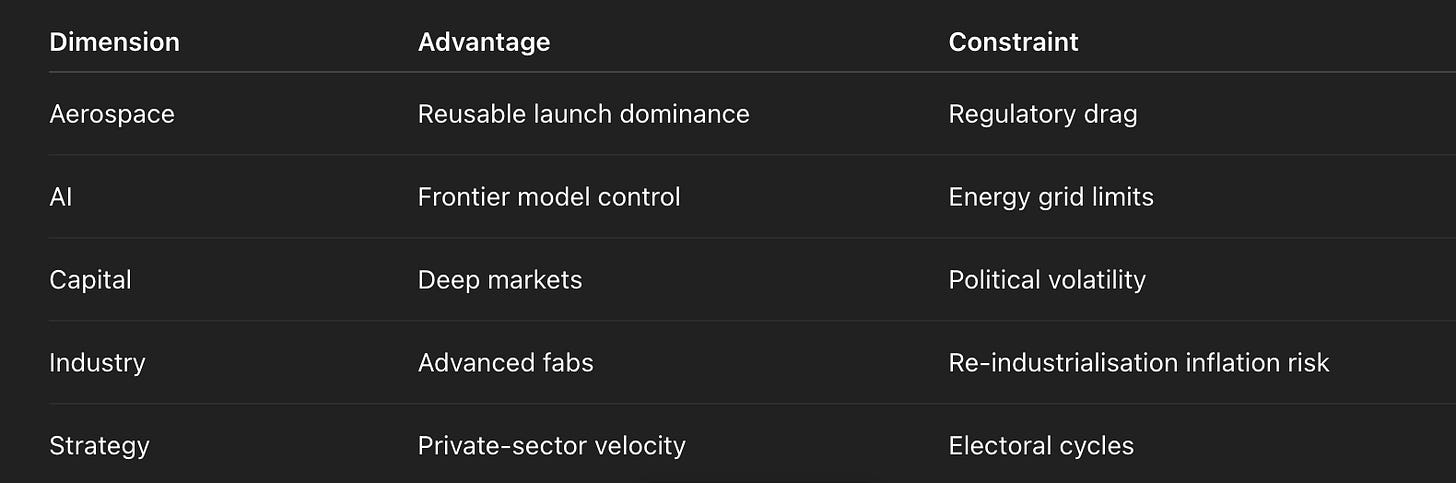

4.1.2 America’s Two Advantages in the Vertical Era

Despite its political chaos, the US enters the orbital century with two overwhelming structural advantages:

Advantage A — Aerospace Dominance

The US private sector leads in:

reusable rockets

launch cadence

in-space manufacturing R&D

satellite constellations

asteroid-resource mapping

autonomous orbital operations

SpaceX already launches more mass annually than all other nations combined.

This matters because, in a vertical economy, mass to orbit is the new GDP.

No country is even close.

Advantage B — AI Leadership

The US controls:

the major foundation models

the chip design ecosystem

the cloud infrastructure

the venture engine that funds risk

the research concentration that compounds scale

A vertical economy runs on compute + autonomy + launch capacity.

America leads all three.

On paper, the US should own the orbital century.

4.1.3 America’s Fatal Constraint: Politics as Gravity

The barrier is not technology.

It is not economics.

It is not China.

It is the United States itself.

America’s domestic system is built for horizontal extraction, not vertical investment.

Its politics reward:

immediate consumption

culture-war distraction

debt-financed comfort

short electoral cycles

hostility to long-term industrial planning

The vertical economy requires:

decade-long infrastructure bets

coordinated industrial strategy

tolerance for short-term pain

unified technological priorities

national discipline

These are not American virtues.

They are American weaknesses.

In a world where physics determine winners, politics becomes America’s gravity well — pulling everything downward, slowing the ascent.

4.1.4 The Strategic Blind Spot: America Still Thinks the Game Is Geographic

Washington still behaves as if the world is a map of alliances and adversaries:

contain China

manage Europe

deter Russia

stabilise the Middle East

All strategies optimized for a world where trade routes and military bases matter more than launch economics and orbital energy capture.

But the vertical era rewrites the hierarchy:

Launch pads > ports

Orbital bandwidth > sea lanes

Energy from orbit > oil fields

Compute clusters in vacuum > data centres in Virginia

America hasn’t updated its worldview to match its own technological frontier.

4.1.5 Can America Migrate Its Power Upward in Time?

The US sits at a crossroads:

Path 1 — The Aerospace Republic

The US doubles down on:

orbital industry

Starship-class logistics

off-world compute

sovereign AI

resource capture beyond Earth

If America embraces this path, it remains the dominant power of the 21st century — not because of ideology, but because vertical industry rewards the exact sectors where America is strongest.

Path 2 — The Debt Empire

The US continues:

borrowing to sustain consumption

defending old horizontal chokepoints

militarising sea lanes

politicising industrial strategy

relying on dollar privilege

This preserves influence today while guaranteeing decline tomorrow.

The uncomfortable truth:

America can dominate the vertical economy — but not if it insists on defending the horizontal one.

4.1.6 The Probable Future — A Split United States

The likeliest scenario is structural duality:

A hyper-advanced aerospace–AI industrial ecosystem

coexisting with

a politically paralysed nation-state.

One part of America will build the future.

The other will fight about the past.

The question for global power isn’t whether America will fall.

It’s whether its techno-industrial engine can detach from its political ballast long enough to shape the orbital century.

History suggests empires die when their political architecture can’t support their technological frontier.

The US is about to test that rule at orbital scale.

4.2 — China: The Industrial Superorganism Aiming Upward

The only civilisation that can scale vertically without changing its politics.

China is not a mystery.

It is a machine — a civilisation-wide operating system optimised for production, scale, and state-directed ambition.

The West still talks about China as if it were a very large factory.

It isn’t.

It is the world’s most coordinated industrial organism, capable of compounding national intent at a speed no democracy can replicate.

Horizontal globalisation made China indispensable.

Vertical industrialisation may make it dominant.

Where America built the horizontal world and now struggles to leave it, China never loved the horizontal game. It used it, extracted from it, and is now quietly preparing for the next one.

And unlike the US, China’s political constraints do not impede vertical expansion — they enable it.

4.2.1 The Only Nation Built for 50-Year Industrial Projects

The Chinese system is uniquely suited to the vertical era because it can:

allocate capital without electoral consent

nationalise entire sectors in a weekend

coordinate universities, industry and military with one directive

build at absurd speed

endure short-term pain for long-term capacity

A vertical economy rewards continuity of intent.

No nation on Earth has more of it.

Most countries make plans.

China makes trajectories.

It does not ask voters whether to invest in hypersonics, orbital factories, chip foundries, or space mining.

It simply designs the endpoint and begins building toward it.

Whether this model is desirable is irrelevant.

What matters is: it maps perfectly onto the demands of verticalisation.

4.2.2 China Already Controls the Mineral Spine of the Vertical Economy

The West spent the last 40 years optimising spreadsheets.

China spent the last 40 years buying the periodic table.

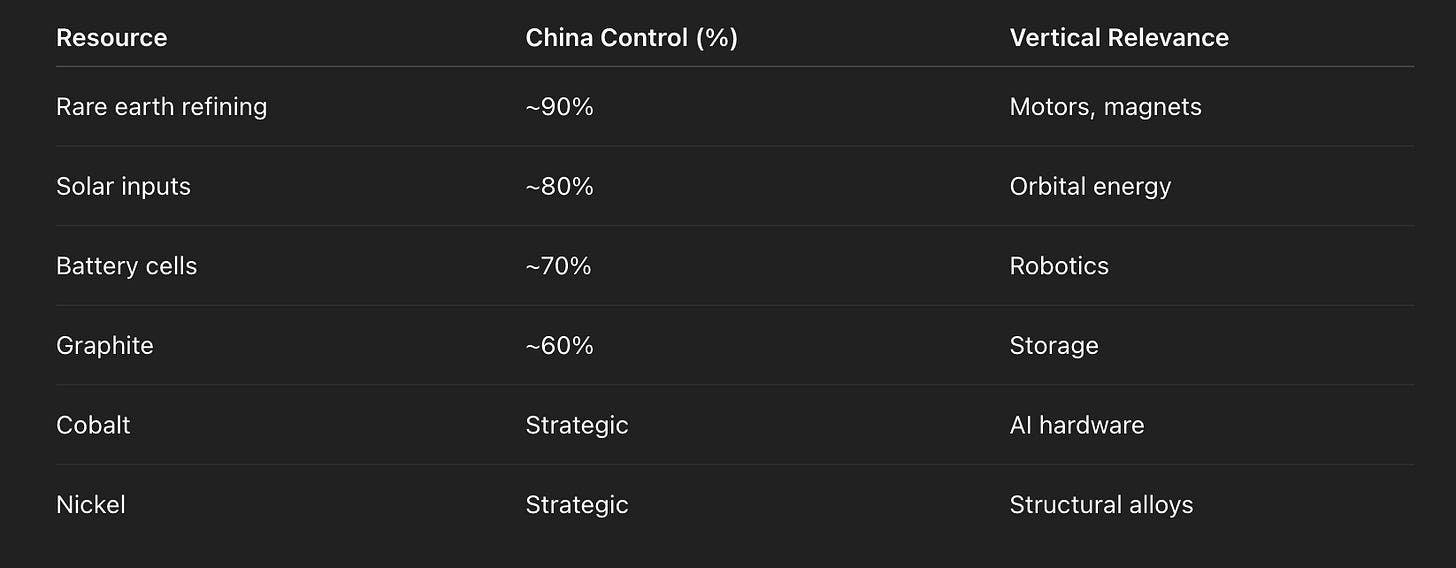

China controls:

90% of rare earth refining

70% of lithium-ion cell production

80% of solar supply chain inputs

60%+ of global graphite

cobalt flows through DRC partnerships

nickel through Indonesia

These are not commodities.

They are the arteries of the AI–robotics–orbital stack.

The vertical economy runs on:

batteries

magnets

high-performance alloys

photovoltaics

semiconductors

autonomous systems

China already owns the midpoints of all six.

This is not an advantage.

It is a moat.

4.2.3 China Understands Capacity Better Than Economics

Western observers say: “But China’s debt is huge! Their property sector is collapsing!”

This is true.

But it reveals a misunderstanding.

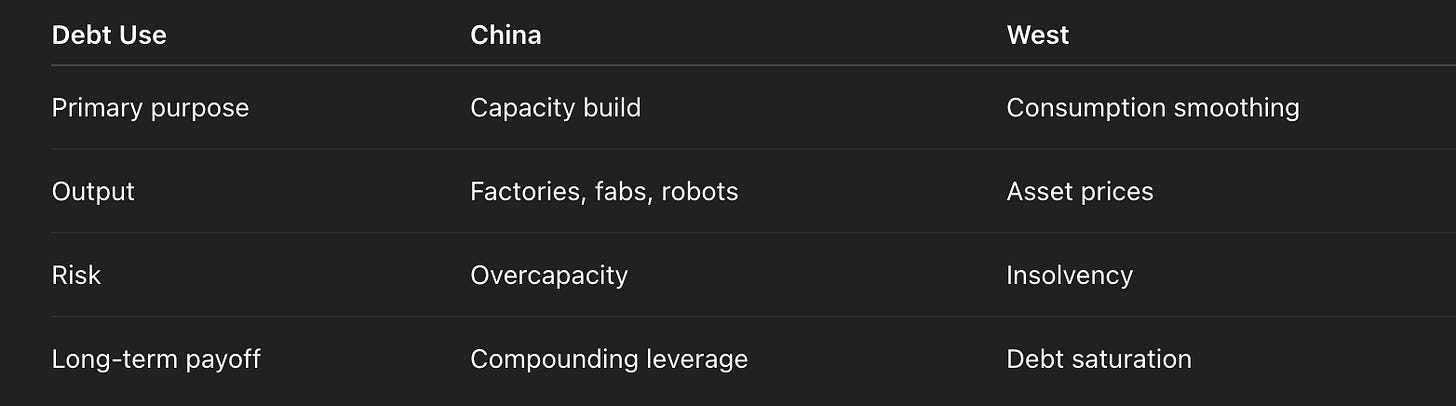

China does not run its economy like a balance sheet.

It runs it like an industrial organism.

Debt → capacity

not

Debt → consumption

Local Government Financing Vehicles (LGFVs) borrow against the state’s future ability to produce things.

The West borrows to sustain lifestyles.

China borrows to build leverage.

The West gets higher house prices.

China gets:

ports

refineries

fabs

shipyards

rail

robotics

industrial clusters

orbital programmes

By 2025, that capacity converted into a $1 trillion trade surplus — the largest in history. Western commentators who spent a decade predicting Chinese debt collapse missed the point entirely. The debt was never the story. The capacity was. And capacity, unlike leverage, compounds.

If the US is a debt empire, China is a capacity empire — and capacity is the premium asset in the vertical era.

4.2.4 China’s Space Ambition Is Not Symbolic — It Is Industrial

Western media treats China’s space programme as prestige politics.

This is a category error.

Every major Chinese orbital initiative maps directly onto industrial objectives:

Tiangong Station → materials science

Chandrayaan partnerships & lunar missions → helium-3, titanium, ilmenite

Long March 9 → heavy lift

Reusable launch R&D → cost curve

Chang’e programme → resource extraction mapping

Queqiao-2 → cislunar comms backbone

China’s ambition is not flags on moons.

It is vertical sovereignty.

Chinese planners have already articulated the goal:

“Industrialising near-Earth space.”

The phrase is not poetic.

It is literal policy.

4.2.5 Demographics: China’s One True Limitation — and Why It Matters Less in a Vertical World

China faces demographic collapse.

That is not a myth; it is a statistical fact.

It will lose 100 million workers by 2040.

Normally, this would be fatal.

But the vertical economy does not require a billion workers.

It requires:

robots

automation

AI-managed factories

unbroken supply chains

energy abundance

China is ahead in four of the five.

Its demographic crisis accelerates the shift toward synthetic labour — the direction it was already travelling.

Where the West sees AI as labour threat, China sees AI as demographic salvation.

4.2.6 Does the Party Survive the Vertical Turn? Almost Certainly.

The vertical economy rewards:

centralisation

capital concentration

supply-chain integration

authoritarian speed

strategic coherence

China has all five.

The only real threat to the CCP is a mass employment crisis — but robotics reduces the scale of that crisis by replacing labour before unemployment becomes politically destabilising.

The irony is sharp:

The technology that threatens Western democracy stabilises the Chinese state.

4.2.7 The China Question for the Orbital Century

China will not defeat America horizontally.

It does not need to.

The real competition is:

Who industrialises orbit first?

Who controls off-world energy?

Who owns compute sovereignty above the atmosphere?

Who can scale industry without voters?

The US has the greater technological edge.

China has the greater political advantage.

The vertical century belongs to the nation that can combine:

aerospace

materials

energy

robotics

AI

long-term planning

Both the US and China have pieces.

Only China treats the puzzle as national destiny.

4.3 — Europe: The Civilisation That Invented Modernity, Then Chose Not to Compete

The world moved into an era where power is industrial, energetic, and orbital — and Europe entered it with the instincts of a museum, not a manufacturer.

Europe’s tragedy is neither decline nor incompetence.

It is elegant misalignment — a civilisation optimised for a world that no longer exists.

Europe built the intellectual architecture of modernity:

science, capitalism, industry, law, the nation-state, the map, the corporation.

But when the world shifted from horizontal growth to vertical competition, Europe had already chosen a different identity:

comfort over scale

welfare over leverage

regulation over ambition

diplomacy over dominance

cultural power over industrial power

This made it the most humane society on Earth — and the least prepared for a world where industrial capacity, energy sovereignty, and orbital reach determine geopolitical survival.

4.3.1 Europe’s Post-War Decision: Prosperity Without Power

After 1945, Europe made a profound, rarely-discussed choice:

never again tie prosperity to militarised industry.

America guaranteed the security umbrella.

Europe built the welfare state.

The result:

The US held the navy.

Europe held the pension funds.

The US controlled energy flows.

Europe controlled quality-of-life metrics.

The US projected force.

Europe projected values.

It was a rational settlement — in a world that no longer exists.

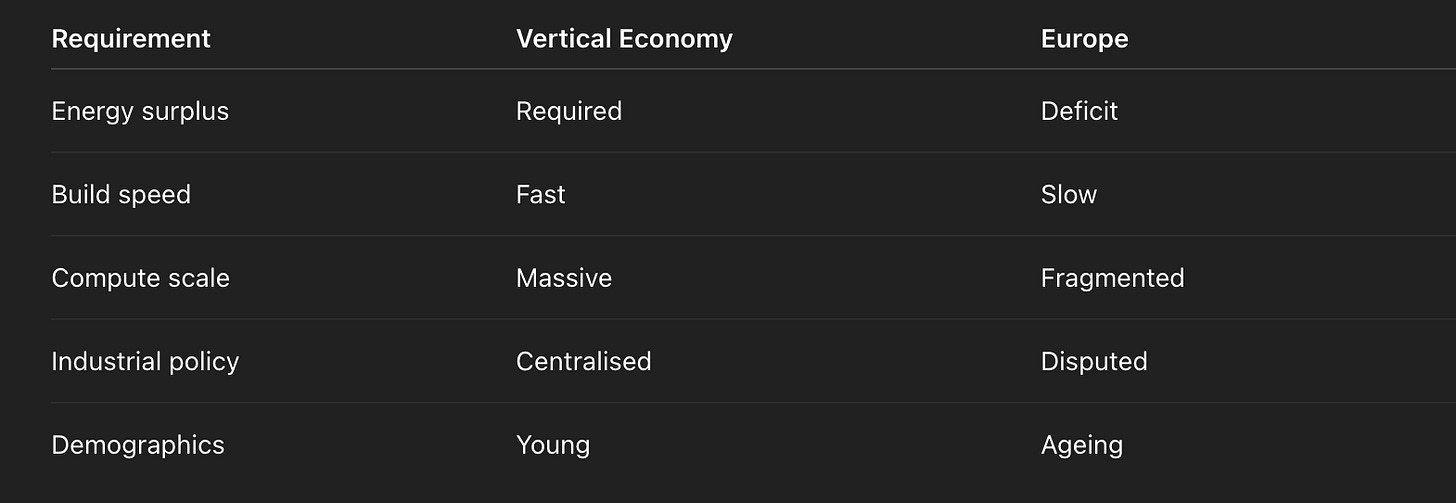

The vertical era demands:

energy abundance

industrial autonomy

compute sovereignty

resource durability

orbital capability

Europe excels at none.

4.3.2 A Continent That Mistook Regulation for Strategy

Europe regulates because it cannot scale.

It constrains because it cannot compete.

GDPR, Digital Markets Act, AI Act — all variations on the same instinct:

If you cannot win the game, rewrite the rulebook.

This worked in the consumer internet era, where Europe was a market, not a producer.

It collapses in the vertical era, where:

energy is sovereignty

compute is power projection

industrial capacity is survival

space is the new manufacturing basin

Europe approaches each with tools designed for vineyards, not shipyards.

4.3.3 The Euro: A Beautiful Idea With Brutal Consequences

The single currency achieved integration without union — a structural contradiction.

It locked:

Germany into permanent surpluses

Southern Europe into permanent austerity

France into permanent negotiation

Europe traded monetary sovereignty for rate stability.

But stable rates mean nothing when:

energy is imported

growth is borrowed

population shrinks

industry leaves

defence is outsourced

The euro is not Europe’s downfall.

It is Europe’s mirror: elegant, rational, and strategically fragile.

4.3.4 Why Europe Missed the AI Wave

Europe has the talent.

Europe even has the ideas.

What it lacks is scale — the only thing modern AI respects.

AI requires:

massive data centres

enormous energy budgets

huge capex

abundant land

lightly regulated build cycles

Europe has:

energy constraints

land constraints

planning constraints

political constraints

environmental constraints

To build a hyperscale LLM cluster, you need 200–400 MW.

Good luck securing that in Belgium, Bavaria, or Provence — where even a wind farm is a national argument.

The vertical economy demands excess.

Europe is allergic to excess.

4.3.5 The Energy Problem Europe Cannot Vote Its Way Out Of

Europe’s greatest vulnerability is simple:

It does not generate the energy it consumes.

It imported Russian gas for industry, Middle Eastern oil for mobility, American LNG for crisis, and African uranium for nuclear plants.

Then the geopolitical floor collapsed.

Germany shut down nuclear.

France’s reactors aged.

Italy chose debt over drilling.

The UK chose politics over storage.

Industrial Europe now runs on imported energy — at the precise moment energy becomes the foundation of AI, robotics, and orbital capability.

In a vertical world, energy is the new navy.

Europe has neither.

4.3.6 The Demographic Implosion That Ends the Old European Model

Europe is ageing faster than its economists can invent metaphors.

By 2050:

Italy loses a third of its working-age population

Spain loses a quarter

Germany becomes a retirement continent

France survives only because of immigration and birth rates

A welfare state without workers is not a welfare state.

It is a transfer system waiting for arithmetic to end it.

And industrial verticalisation requires:

young engineers

builders

technicians

operators

Europe has retirees.

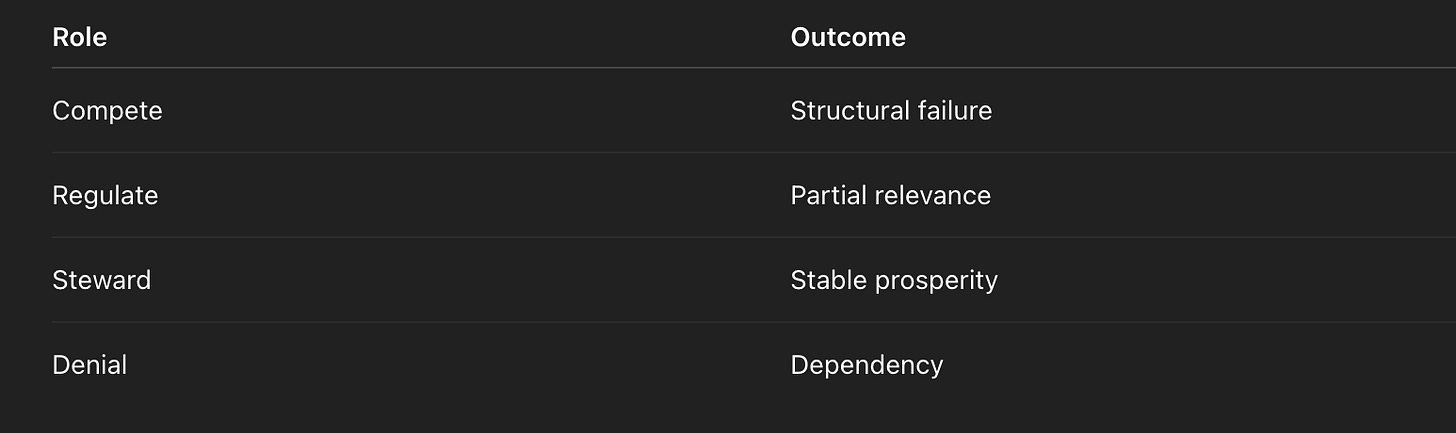

4.3.7 Why Europe Cannot Lead the Vertical Turn — But Could Benefit From It

Europe will not industrialise orbit.

It cannot build the energy base or political alignment required.

But Europe could benefit from the vertical turn, if it accepts a new role:

Earth as sanctuary

Orbit as production

Europe as steward, not competitor

A world where:

heavy industry leaves Earth

orbital energy lowers global prices

off-world compute reduces land pressure

manufacturing migrates to microgravity

Europe focuses on culture, governance, and quality of life

Europe becomes the planet’s operating system, not its factory.

It is not dominance.

It is relevance — preserved by acknowledging limits.

4.3.8 The Hard Question for Europe

Does Europe want to be:

a participant in the vertical century,

an observer,

or a beautifully preserved relic of the horizontal one?

Europe has chosen comfort for 70 years.

The vertical era turns comfort into dependency.

A continent that once invented the future must now decide whether it wants one.

4.4 — India: The Demographic Swing State

A billion-person labour engine entering the first age where labour is no longer scarce.

India arrives at the exact moment the world’s economic logic flips.

For forty years, the global bargain was simple: the West financed demand with debt; Asia supplied capacity with labour. India sat adjacent to that bargain — large, poor, under-built, always “next decade”.

Now the developed world has a debt–productivity break, China has a demographic cliff, and AI is turning labour from constraint into commodity. India becomes the swing state not because it is morally superior, but because it is the last major economy where the maths still behaves like capitalism: debt broadly converts into output.

That 1:1 relationship — roughly a dollar of GDP growth for a dollar of debt growth — is not a statistic. It is an operating system. It means borrowing is still linked to productive expansion rather than political pacification.

4.4.1 Why India’s Human Capital Paradox Is Perfect Timing

India’s “paradox” has always been visible: a massive population with uneven infrastructure, uneven education, uneven state capacity — and therefore uneven productivity.

In a labour-scarce world, this is a weakness. In a labour-abundant world, it becomes timing.

AI compresses capability. It lowers the premium on legacy institutional perfection and raises the premium on scale, adaptation, and absorption. India doesn’t need to copy the West’s twentieth-century model — the one now failing under its own debt weight. It needs to ride the transition: human scale + machine leverage.

India’s demographic dividend is not “more workers”. It is more optionality: more builders of physical infrastructure while the West argues about permits; more engineers while China ages; more consumers in a world where terminal demand becomes the central risk.

4.4.2 Indian Conglomerates as Off-World Partners

Vertical industry will not be built by states alone. It will be built by firms that behave like states: controlling capital, logistics, energy, and industrial planning.

India already has these organisms: conglomerates with long time horizons, balance sheets large enough to absorb infrastructure, and a cultural tolerance for “mess” that the West has regulated out of itself.

As the vertical economy forms, India’s advantage is not that it will “own orbit”. It is that it can partner into orbit without needing to win the first-mover race. It can supply the missing piece in most vertical coalitions: scale labour in the build-out decade, before labour fully decouples from wages.

4.4.3 The Soft Power Advantage: Diaspora as Infrastructure

India’s quiet strategic asset is not a weapon system. It is human distribution.

A diaspora embedded inside US tech, Gulf finance, British institutions, and global medicine becomes a bridging layer: trust, talent flows, deal formation, cultural translation. In a vertical world, alliances become supply chains. Diaspora becomes connective tissue.

This is not sentimental “soft power”. It is operational capacity.

4.4.4 The Vacuum Left by China’s Ageing Curve

China’s demographic reversal creates a vacuum that cannot be filled by policy slogans. When the working-age base shrinks, the export machine either automates or slows. China will automate — aggressively — but that creates a different vacuum: global demand.

A world where China produces cheaply with robots while the West’s middle class is hollowed out by debt and wage stagnation is the terminal demand problem in motion. India matters because it can become what the West no longer is: a demand engine supported by real income growth rather than leveraged consumption.

India is not the “next China”. It becomes something more strategically useful: the stabiliser in a world where both Western debt economics and Chinese overcapacity threaten the demand floor.

4.5 — The Gulf: The Energy Barons Become Compute Barons

From oil states to sovereign compute states — a transformation already underway.

If the twentieth century made the Gulf rich, the twenty-first gives it relevance.

The West treats the Gulf as an energy appendage. The vertical economy treats it as a platform: capital + energy + geopolitical flexibility + a willingness to build infrastructure fast. In a world where compute is the new heavy industry, the Gulf’s core competence — converting resource rent into strategic infrastructure — becomes decisive.

4.5.1 From Petrodollar to “Petra-Compute”

Oil priced in dollars was never just commerce. It was a geopolitical circuit: energy demand created dollar demand; dollar demand funded American deficits; deficits sustained the horizontal order.

But AI flips the energy story. The most important energy is no longer what moves cars. It is what runs intelligence.

The reserve currency of the vertical age is not a note. It is capacity: guaranteed, scalable watts feeding scalable compute. The Gulf can export that capacity — not only as LNG, but as sovereign compute.

4.5.2 Why the Gulf Can Build Orbital Infrastructure Faster Than the West

Verticalisation is infrastructure first, ideology last.

The West has money but not mandate. Europe has legitimacy but not velocity. The US has capability but not political coherence.

The Gulf has the opposite profile: fewer veto points, concentrated capital, and a proven model of state-led build-out. It can decide, fund, and execute without pretending every project needs a decade of cultural debate.

That matters because the first mover advantage in orbit is not about flags. It is about cadence and sunk cost.

4.5.3 Sovereign AI, Sovereign Clouds, Sovereign Launch Capacity

The Gulf’s strategic arc is logical:

energy surplus becomes compute surplus

compute surplus becomes AI sovereignty

AI sovereignty becomes geopolitical leverage

In the debt–productivity world, sovereignty has shifted from “can you borrow?” to “can you run the machines?” The Gulf can run them — and can increasingly choose whose models run on its power.

Launch capacity is the next rung. Not because the Gulf needs to compete with SpaceX, but because access terms become strategic fragility. In a vertical world, renting your lift is like renting your navy.

4.5.4 The Rise of the Cislunar Energy Grid

The Gulf’s long play is not merely data centres in the desert. It is positioning for the off-world energy layer: orbital solar, beamed power, and the logistics of cislunar infrastructure.

The Gulf understands rentier dynamics. It understands chokepoints. It understands how infrastructure becomes power.

The vertical economy does not eliminate the Gulf’s relevance. It upgrades it.

4.6 — Africa & Latin America: The Resource Powers Rediscovered

Verticalisation makes minerals strategic again — and both continents are resource kingdoms.

The vertical turn is often framed as escape from Earth. It is not.

It is industrial separation: heavy compute and heavy manufacturing migrate upward; resource extraction remains brutally terrestrial. Gravity-free manufacturing still begins with gravity-bound minerals.

Which means the continents that the twentieth century treated as “developing markets” become, again, what they always were: resource basins.

4.6.1 Why Gravity-Free Manufacturing Needs African Minerals

You cannot build orbital industry out of ideology.

You build it out of aluminium, titanium, copper, nickel, cobalt, rare earths, silicon inputs, high-purity chemicals. The clean abstractions of AI sit on a dirty foundation: mining, refining, processing.

Africa’s centrality returns because vertical industry is materials-intensive. Not optional. Intensive.

The question is whether Africa captures value or repeats the old pattern: exporting ore, importing finished goods, and calling it “growth”.

4.6.2 Brazil, Argentina and the New Lithium Hegemony

Latin America sits on one of the key choke resources of the AI–robotics stack: lithium and associated battery inputs.

As the world moves into machine labour and orbital logistics, storage matters. So does grid resilience. So does the ability to stabilise energy flows for compute.

The vertical economy increases the strategic value of these regions — but it also increases external pressure to control them through contracts, debt, and “partnerships”.

4.6.3 The Long Arc: “Those Who Hold the Minerals Hold the Orbit”

This is not a slogan. It is a reminder of how power actually behaves.

The debt–productivity break has pushed the West into financial engineering again: sanction regimes, capital controls, export restrictions, subsidy wars. But none of those create minerals.

If vertical capacity becomes the new reserve currency, then the mineral spine becomes the mint.

The winners in Africa and Latin America will be states that convert mineral leverage into industrial capacity — and refuse to be paid in promises.

4.7 — The First Orbital Coalitions

New alliances that don’t look like NATO, BRICS, or the EU — but like supply chains.

Old alliances were territorial. New alliances will be technical.

When the centre of gravity shifts upward, coalitions stop forming around borders and start forming around stacks: launch, energy, compute, materials, autonomy, insurance, standards.

4.7.1 The Compute Alliance (US + Gulf + East Asia)

This coalition forms naturally around complementary strengths:

US: frontier models, chip design, platform dominance

Gulf: energy surplus + capital + build speed

East Asia: manufacturing precision, supply-chain depth, systems engineering

This is the coalition that tries to preserve the old world’s benefits — without the old world’s labour economics. Its risk is the terminal demand problem: if labour’s share collapses and income redesign lags, the compute economy produces intelligence into a shrinking consumer base.

4.7.2 The Industrial Alliance (China + BRICS Metals Belt)

This coalition is capacity-first: minerals, refining, factories, robotics, and a political tolerance for state-directed build-out.

It is structurally aligned with verticalisation because it is already aligned with industrial sovereignty. Its risk is overcapacity in a demand-constrained world — and the inevitable backlash when exporting deflation becomes geopolitical friction.

4.7.3 The Regulatory Alliance (Europe + Japan)

Europe and Japan will likely become what they are best at: rule-making, standards, safety, constraints.

In a vertical world, that may sound weak. It isn’t necessarily. Standards are control mechanisms when you cannot dominate infrastructure. But it is also an admission: you are shaping the game because you cannot win it on mass.

4.7.4 The Non-Aligned Orbital Movement

Neutrality will reappear — not as moral posture, but as bargaining strategy.

States will attempt to avoid choosing between stacks by selling access: geography, ports, minerals, data routes, legal domiciles. Some will succeed. Many will discover that neutrality in a compute economy is mostly branding.

4.7.5 Why Alliances Become Technical, Not Territorial

Territory mattered when production and energy were land-bound.

In verticalisation, the binding constraint is the stack: who can move mass, convert energy, run compute, insure risk, and sustain cadence. Alliances become procurement.

And procurement has no loyalty.

4.8 — War in a Vertical World

Not lasers in space — but economic enforcement.

War will not become cinematic. It will become infrastructural.

The central contest is not “who can destroy satellites”. It is “who can deny capacity”.

4.8.1 Orbital Blockades, Not Naval Ones

Naval blockades mattered because shipping mattered.

Orbital blockades will matter because lift and resupply matter. Deny launch windows. Deny propellant depots. Deny insurance. Deny docking rights. Deny parts.

You don’t need to shoot anything. You just need to make it uneconomic to operate.

4.8.2 Satellite Spoofing as the New Oil Embargo

A modern economy runs on timing: GPS, comms, synchronisation, logistics optimisation.

Spoofing and denial degrade that timing. They don’t “destroy” a country. They make it inefficient. And inefficiency is the new pain.

4.8.3 The Weaponisation of Launch Capacity

Launch becomes the new industrial chokepoint.

In the horizontal era, the UK discovered what market discipline looks like without reserve currency privilege — the 2022 gilt crisis was a reminder that credibility is an input, not a virtue. In the vertical era, the equivalent is lift discipline: you may have capital, but if you do not have reliable access to launch, your sovereignty is leased.

4.8.4 The End of Mutually Assured Destruction?

MAD assumed symmetrical destruction risk.

Vertical conflict trends asymmetric: denial, degradation, sabotage, sanctions, standards warfare, insurance warfare. It is less “end of the world”, more “end of your growth model”.

Which is precisely why it’s more likely.

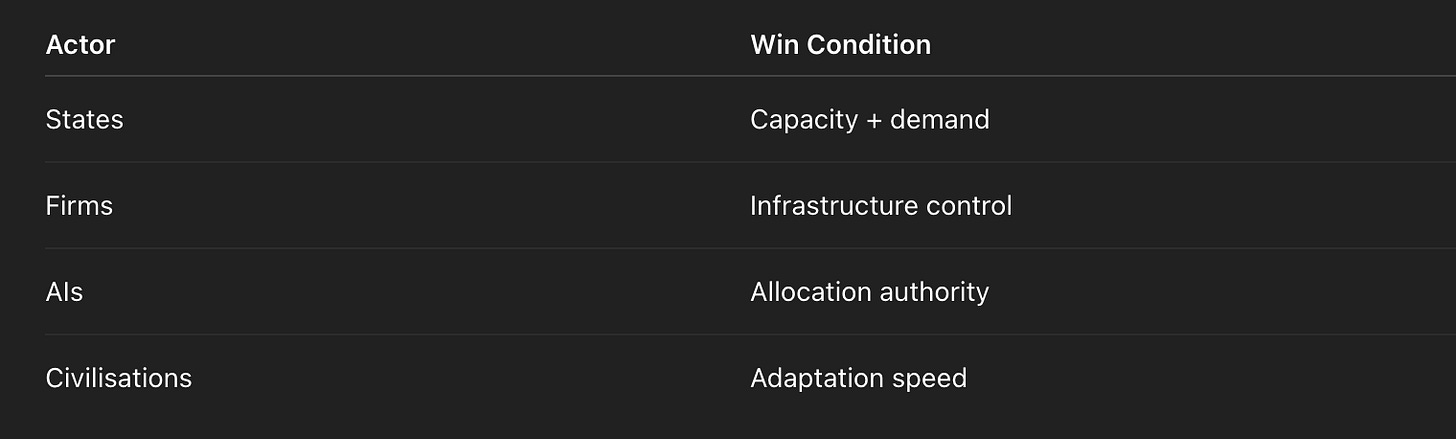

4.9 — The Winners of the Vertical Economy

A sober, unsentimental conclusion.

The vertical economy is not a morality play. It is a sorting mechanism.

In the debt–productivity era, nations were ranked by their ability to borrow cheaply and maintain the illusion. In the vertical era, nations will be ranked by their ability to build capacity — energy, compute, launch, materials, autonomy — and maintain demand in a world where labour’s share trends toward zero.

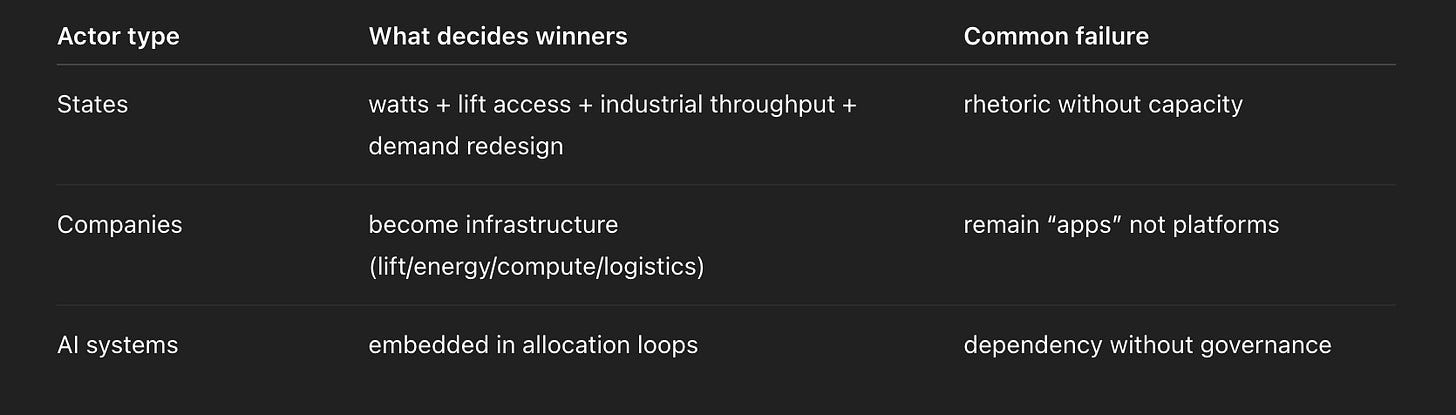

4.9.1 The States With Capacity, Not Rhetoric

Winners are states that can do three things at once:

fund long-duration infrastructure without political collapse

secure energy surplus and grid expansion (or bypass it via orbit)

redesign income participation fast enough to prevent terminal demand failure

India matters here because its debt still buys growth. The Gulf matters because it can translate energy into compute and capital into infrastructure. The US matters because it owns the frontier stack — if it can stop sabotaging itself. China matters because it can coordinate capacity at scale — if it can manage demand and demography.

Europe matters if it becomes an architect of rules that actually bind — not a curator of values that don’t.

4.9.2 The Companies That Become Infrastructure

The biggest winners will not behave like companies.

They will behave like utilities, ports, and sovereign platforms: controlling lift, compute, energy routing, orbital logistics, and standards. They will become the civilisational plumbing — and the state will bargain with them accordingly.

4.9.3 The AIs That Become Political Actors

When compute is sovereignty, the systems that allocate compute become political actors by function, even if nobody grants them formal status.

If an AI manages logistics, allocates energy, runs industrial planning, and optimises defence systems, it is embedded in decision loops that governments cannot fully audit or replace quickly. Agency emerges through dependency.

Politics doesn’t like admitting that. Reality doesn’t care.

4.9.4 Civilisations That Adapt — and Those That Don’t

The cleanest dividing line is not democracy vs authoritarianism.

It is adaptation vs denial.

The late horizontal world specialised in denial: debt as prosperity, asset inflation as welfare, models as truth. The vertical world punishes that. It rewards nations that accept arithmetic early, build capacity before it is fashionable, and redesign the human income link before the terminal demand problem becomes irreversible.

The vertical economy will not “save” civilisation.

It will expose which civilisations were real — and which were leveraged stories that finally ran out of tomorrow.

Thank you for reading. If you liked it, share it with your friends, colleagues and everyone interested in the startup Investor ecosystem.

If you've got suggestions, an article, research, your tech stack, or a job listing you want featured, just let me know! I'm keen to include it in the upcoming edition.

Please let me know what you think of it, love a feedback loop 🙏🏼

🛑 Get a different job.

Subscribe below and follow me on LinkedIn or Twitter to never miss an update.

For the ❤️ of startups

✌🏼 & 💙

Derek