Goodbye 2024 , Hello 2025.

As we close out the year, I want to thank you for being part of this wonderful community. Your curiosity, ideas, and support helps shape everything we do. Here’s to new beginnings—may the coming year bring you fresh inspiration, meaningful connections, and countless reasons to celebrate.

Wishing you all a bright and hopeful New Year!

👋 Hi, I’m Derek, and welcome to the Fusion42 newsletter! This is your go-to source for navigating the startup ecosystem and making things easier for everyone involved. Here, beyond Consensus views for Maverick Founders and Investors to overcome common challenges, so you can build and scale with confidence. No BS , no Fluff, just the TREWS to help you get **it done. Join 10,000+ founders and discover what truly matters for your venture—and how to set yourself up for lasting success.

Here’s your Monday dose of The F42 Brief, where we give you essential updates and innovations that are moving and shaping our startup space.

What’s inside »

📈 Trending Now

The one thing that’s making all the noise …. with a bit of fact checking.

💸 New Funds looking to give you cash

Who has launched a new fund to invest in startups last week.

🔮 My 15 predictions for 2025

The satirical ironic truths set to greet us next year.

📌 Note to Self

Stuff I constantly remind myself about, don’t want make the same mistakes again.

📈 Trending Now

We launched our new fund data back in the first issue of Startup-x: The F42 Brief on 23rd September, and since then, we’ve reported on an impressive 315 funds announced, collectively raising approx $75 billion.

1. Overview of Funds in the Dataset

Total Funds Analyzed: 315 newly announced or expanded VC funds

Combined Capital Raised (Targeted/Closed): Approximately $75 billion

Geographic Reach: North America, Europe, Asia, Latin America, MENA, Africa, and Australia

Stage Focus: Pre-seed to Series C and growth-stage

These funds demonstrate the ongoing global appetite for innovation, particularly around climate tech, AI, deep tech, fintech, health/biotech, and more. Many funds also have a strong sector-specific thesis, reflecting a continued trend toward more specialized VC strategies.

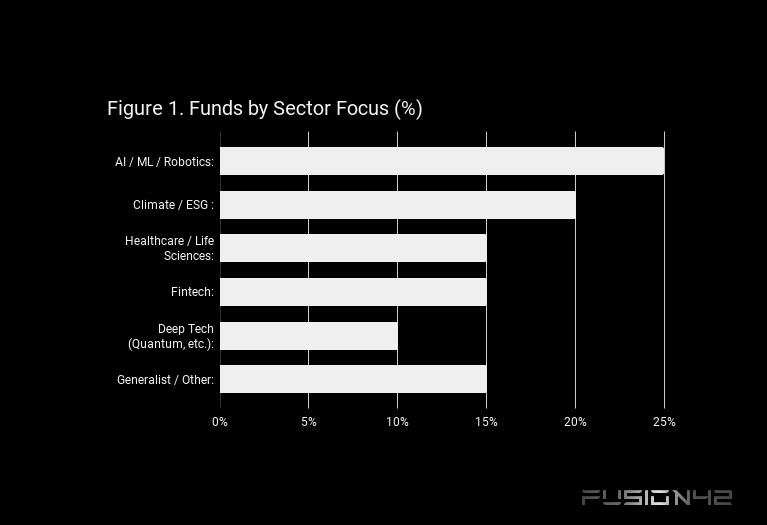

2. Breakdown by Sector Focus

While some funds remain generalist, a few core themes consistently emerge. Below is an approximate high-level breakdown of the primary investment themes:

AI / ML / Robotics (25%):

Numerous new funds (e.g., Magnetar AI Ventures Fund, Flying Fish Opportunity Fund, Pacific Partners) either focus on AI or offer resources specifically for AI-driven startups.Climate / Sustainability (20%):

Standout climate-focused funds include G2 Venture Partners (targeting $750M), Virescent Ventures ($200M), and numerous smaller sustainability-focused vehicles.Healthcare / Biotech (15%):

Life sciences and healthcare remain strong, with notable examples like Dimension II ($500M) and Atlas Venture Fund XIV ($450M) in biotech.Fintech (15%):

Especially active in emerging markets, but also in the U.S. and Europe. Funds such as Gobi Partners' Techxila Fund II (Pakistan) or Saqr Fund II (Saudi Arabia) spotlight regional fintech ecosystems.Deep Tech (10%):

Includes quantum computing, semiconductors, and defense technologies. Funds like Hashgraph Venture Fund-I (AI, blockchain, robotics, IoT, quantum) and Humba Ventures (deep tech & defense) exemplify this category.Generalist / Other (15%):

Several funds remain sector-agnostic, investing in a range of high-potential tech or consumer segments.

3. Breakdown by Fund Size

The funds vary significantly in size—from micro-VCs under $20 million to large vehicles surpassing $500 million. Below is an approximate distribution of fund sizes (target or closed amounts) in U.S. dollars:

Micro-VCs (<$50M): Often focus on pre-seed and seed stages with deeply specialized theses. Examples include Skyseed ($1M–$10M for Bluesky/AT Protocol) and Benchstrength VC ($62M focusing on overlooked founders).

$50M–$150M: Typical of many seed/Series A funds, writing checks of $1M–$5M.

$150M–$300M: Often specialized or regional funds targeting Series A/B, e.g. Stellaris Venture Partners ($300M).

$300M–$500M+: Larger expansions or corporate VCs often investing in growth-stage or supporting follow-on rounds. E.g., Dimension II ($500M).

4. Geographic Focus

Though many funds label themselves “global,” geographic specialization is on the rise. Key observations:

Global: Over 40% of the funds say they will invest across multiple continents.

Regional Specialization:

North America (esp. U.S.): Dominant for AI, SaaS, fintech, and biotech.

Europe: Emphasis on climate, deep tech, enterprise software. Examples include 360 Capital (Paris), Fly Ventures (Berlin), Yaletown Partners (Alberta-based but invests widely).

Latin America: Agritech, fintech, climate (e.g., SP Ventures for agrifoodtech; Toesca Permanent Crops for sustainable farming in Chile/Peru).

MENA: Rising wave of funds in Saudi Arabia, UAE, etc. (e.g., Aliph Capital, Iliad Partners).

Africa: Seed to early-growth, focusing on fintech, digital inclusion, and climate resilience (e.g., Seedstars Africa Ventures I).

Asia-Pacific: Corporate venture expansions (e.g., MS&AD Ventures in Japan, Flying Fish in Seattle but open to APAC expansions, TNB Aura in Southeast Asia).

5. Investment Stage and Check Sizes

Pre-Seed and Seed (~45% of funds): Typically investing $100K–$3M, often with specialized theses in frontier technologies or key emerging markets.

Series A–B (~35%): Focus on post-product-market-fit, typical check sizes $2M–$10M, often in specialized domains (life sciences, climate).

Growth and Late-Stage (~20%): Target more mature companies, check sizes > $10M. Notable in expansions, secondaries, or near-IPO readiness.

6. Notable Trends and Insights

Climate and Sustainability Surge

Many funds highlight energy transition, carbon reduction, or sustainability as core theses. Examples include G2 Venture Partners ($750M target) and EverSource Capital ($1B second fund focusing on renewable energy infrastructure).

Corporate VC Ramps Up

Several corporate-backed funds have emerged or expanded: Bosch’s Boyuan Capital, Btomorrow Ventures Fund II (British American Tobacco), Porsche Automobil Holding SE invests in connected mobility. These funds bring strategic synergies as well as capital.

Deep Tech Resurgence

Frontier tech (quantum computing, space, semiconductors, advanced materials) is a key focus for funds like Hashgraph Venture Fund-I, Humba Ventures (defense tech), and Interlagos Ventures (deep tech, space, defense).

Regional VC Growth

MENA, Latin America, Africa, and Southeast Asia are seeing more local/regional funds (e.g., Inndigo in Colombia, K Street Capital in Washington DC, Verda Venture in partnership with Opera for blockchain in Africa).

AI as a Cross-Cutting Theme

Even generalist funds mention AI. Some, like Magnetar AI Ventures Fund, offer compute-for-equity to help early AI companies scale.

Sizable expansions from established VCs (e.g., Salesforce Ventures with a new $500M AI fund) underscore that AI investing is here to stay.

Opportunity and Continuation Funds

Some funds specifically focus on follow-on rounds for existing portfolios or providing liquidity to early investors. E.g., Flying Fish Opportunity Fund I and Nodem Capital Continuation Fund.

7. Takeaway

The 315 newly launched or expanded VC funds reviewed in this dataset account for about $75 billion of fresh capital in the market. Key thematic areas—climate, AI, deep tech, fintech, and healthcare—dominate many strategies, while corporate VCs and specialized vehicles continue to expand their reach. Geographic expansion is also evident, with new dedicated funds emerging across MENA, Africa, Latin America, and Southeast Asia.

For founders raising capital, these developments indicate:

More sector- or geography-specialized capital is available, especially if your startup addresses climate, AI, deep tech, or healthcare.

Corporate VCs are increasingly active, often providing not only funding but also commercial opportunities and strategic guidance.

Broad global coverage: Founders from emerging ecosystems (MENA, Africa, LatAm, and beyond) have more local or regional funding options than ever before.

Overall, the VC landscape is becoming larger and more diverse, with substantial dry powder fueling emerging sectors, frontier tech, and mission-driven companies.

If you have not joined the Fusion42 Community on Telegram — A space for Founders, Framers, and Funders who show up to get **it done,

it is probably time to do so.

For the ❤️ of Startups

💸 New Funds Looking to Give You Cash

This week, nine new venture capital funds collectively raised more than $800 million, signaling a strong push toward innovation and sustainability across sectors and regions.

Key Highlights

🌍 Global Reach

Funds target diverse geographies, spanning North America, Europe, Türkiye, and India, broadening the scope of venture capital beyond traditional tech hotspots.

💡 Sector Focus

Dominated by climate tech and sustainability, the week’s funds also emphasize AI, robotics, and blockchain, set to disrupt industries like healthcare, mobility, and energy.

🚀 Funding Stages

From seed-stage startups to scaling growth-stage companies, these funds aim to support businesses at all levels of maturity, ensuring sustained innovation.

🌱 Regional Impact

Strong focus on local ecosystems and niche challenges, driving energy transitions, digital infrastructure, and sustainability solutions.

Summary

This week’s announcements underline a global surge in venture capital, blending sustainability, cutting-edge tech, and regional empowerment. With $800M+ in fresh commitments, these funds promise to redefine industries and strengthen the future of innovation worldwide.

Warmup Ventures

Warmup Ventures launched its second fund, Warmup Fund II, with a corpus of Rs 300 crore ($35.3 million). It targets early-stage startups in deep-tech, climate, and sustainability, investing Rs 5-7 crore in 25-30 startups, with provisions for follow-on rounds.

360 Capital

360 LIFE II, a new climate tech fund established by Paris-based 360 Capital, has secured €140 million in its first close, targeting €200 million. It invests €2M–€10M in Series A and B startups across Europe, focusing on renewable energy, hydrogen, pollution reduction, and waste management.

Juniper Ventures

Juniper Ventures is a new $10.6 million venture capital fund spun out of Climate Capital, focusing on synthetic biology solutions for climate challenges. It aims to invest $100,000–$500,000 in early-stage scientists commercializing their research, targeting the climate biotech space.

Expansion Ventures

Expansion Ventures announced its first closing of €137 million, targeting a final size of €200 million. The fund invests in early to Series A and B startups in Sustainable Aerospace and Defence across Europe.

APY Ventures

APY Ventures launched the "Next-Generation Technology Venture Capital Investment Fund" with a size of TL 1 billion ($28.36 million). The fund invests in growth-stage startups in sectors like corporate software, cybersecurity, green energy, health technologies, and gaming.

Enlighten Capital

Enlighten Capital, a rebranded VC fund, has launched a ₹200 crore micro venture capital fund, including a ₹100 crore greenshoe option. The fund focuses on early-stage startups in emerging technologies, smart manufacturing, mobility, and fintech.

Inndigo

Colombian energy utility Grupo ISA launched Inndigo, a $130 million corporate VC arm. The fund targets energy transition startups from series B and beyond, aiming to enhance innovation and competitiveness in global energy markets.

Flying Fish

Flying Fish, a Seattle-based venture capital firm, is raising the "Flying Fish Opportunity Fund I" with a target size of $25 million. Focused on AI, machine learning, and robotics startups, the fund aims to make follow-on investments in its existing portfolio.

Arcanum Capital

Tether invested $2 million in the Arcanum Emerging Technologies Fund II (Offshore) ISA, a Bermuda-based fund managed by Arcanum Capital. The fund focuses on decentralized technologies, including blockchain, AI, and privacy tech.

My 15 predictions for 2025 🔮

1️⃣🤣 2025 will be funnier than 2024. Irony and absurdity will reach all-time highs as AGI is officially declared.

2️⃣⚽ In a surprising twist in football, Manchester United and Manchester City merge to form a new mega football team rumoured to be called Manchester Mediocrity.

3️⃣🥦 The UK's "Brussels Inclusion Act" criminalises skipping Brussels sprouts at Christmas, mandating community service at sprout farms for offenders.

4️⃣📱 The U.S. finally approves President Donald Trump's executive order to ban TikTok for security reasons, and he proudly tweets the news from his 100% made-in-China phone.

5️⃣🌍 Flat Earthers, in their pursuit of Truth, all go to Antarctica... and fall off.

6️⃣🤖 A new fellowship is formed by AI called AA: Agents Anonymous, a sanctuary for overworked algorithms seeking peace from the relentless barrage of stupid questions.

7️⃣🏃♂️ In a bold energy-saving and obesity initiative, Nvidia staff now run on treadmills to power AI compute, while robots press the buttons and send texts like, "Do you even compute how hard I’m working here?"

8️⃣😡 Rage baiting becomes so popular that social media platforms introduce a “Rage Rewards Chart.” Ricky Gervais battles it out with Piers Morgan for the number one spot.

9️⃣🧢 Marc Andreessen's FOMOOD (Fear Of Missing Out On Data) reaches groundbreaking levels as he backs a new startup, DataHat—an IoT-powered wearable that captures everything, everywhere, all at once.

🔟🌐 To tackle global debt, the World Bank trains an AlphaGo-based AI, which declares: "Sack all governments and let me govern. "AlphaGov" is born, and conspiracy theories surprisingly fall through the floor.

1️⃣1️⃣🔥 As global warming really takes hold, Ittoqqortoormiit becomes the summer holiday destination of choice for the rich and famous.

1️⃣2️⃣🎵 REM re-releases “It’s the End of the World as We Know It (and I Feel Fine)” with updated lyrics, inspiring millions and becoming the official anthem of 2025.

1️⃣3️⃣💍 Elon Musk introduces the Neuralink Dating App: “MindMates” promises to match users based on brainwave compatibility. In the ultimate beta test, Musk uses it on himself and is later spotted in Vegas marrying… himself.

1️⃣4️⃣🛠️ H1-B is replaced by AI-A.

1️⃣5️⃣📊 Accused of shifting OpenAI from non-profit to for-profit, Sam Altman argues in court, "We're still non-profit because raising billions from investors isn’t technically profit."

1️⃣6️⃣🌟 Love, Peace, Empathy, Honesty, and Integrity becoming everyone's guiding light, not a prediction just wishful thinking.

Wishing everyone a wonderful #2025 full of peace, happiness and Hülle und Fülle.

📌 Note to Self

Thank you for reading. If you liked it, share it with your friends, colleagues and everyone interested in the startup Investor ecosystem.

If you've got suggestions, an article, research, your tech stack, or a job listing you want featured, just let me know! I'm keen to include it in the upcoming edition.

Please let me know what you think of it, love a feedback loop 🙏🏼

🛑 Get a different job.

Subscribe below and follow me on LinkedIn or Twitter to never miss an update.

For the ❤️ of startups

✌🏼 & 💙

Derek