Another coffee and a bit of thinking later… and the whole “sovereign AI” narrative starts to look like theatåre. You can build all the datacentres you like, announce GPU parks, and launch national AI models — buåt the world simply can’t produce enough leading-edge chips. And here’s the uncomfortable bit: if you want more chips, you need more fabs — and that path is overwhelmingly European-gated. This is the part of the story nobody tells, because most people don’t understand how the compute stack actually works.

Everyone can buy GPUs. Few can secure wafers. Almost nobody can secure Extreme ultraviolet radiation EUV.

Governments sell the dream of:

“sovereign compute”

“national AI stacks”

“frontier model independence”

But sovereignty doesn’t start at GPUs. It starts five layers upstream, in physics and supply chains that don’t care about political speeches.

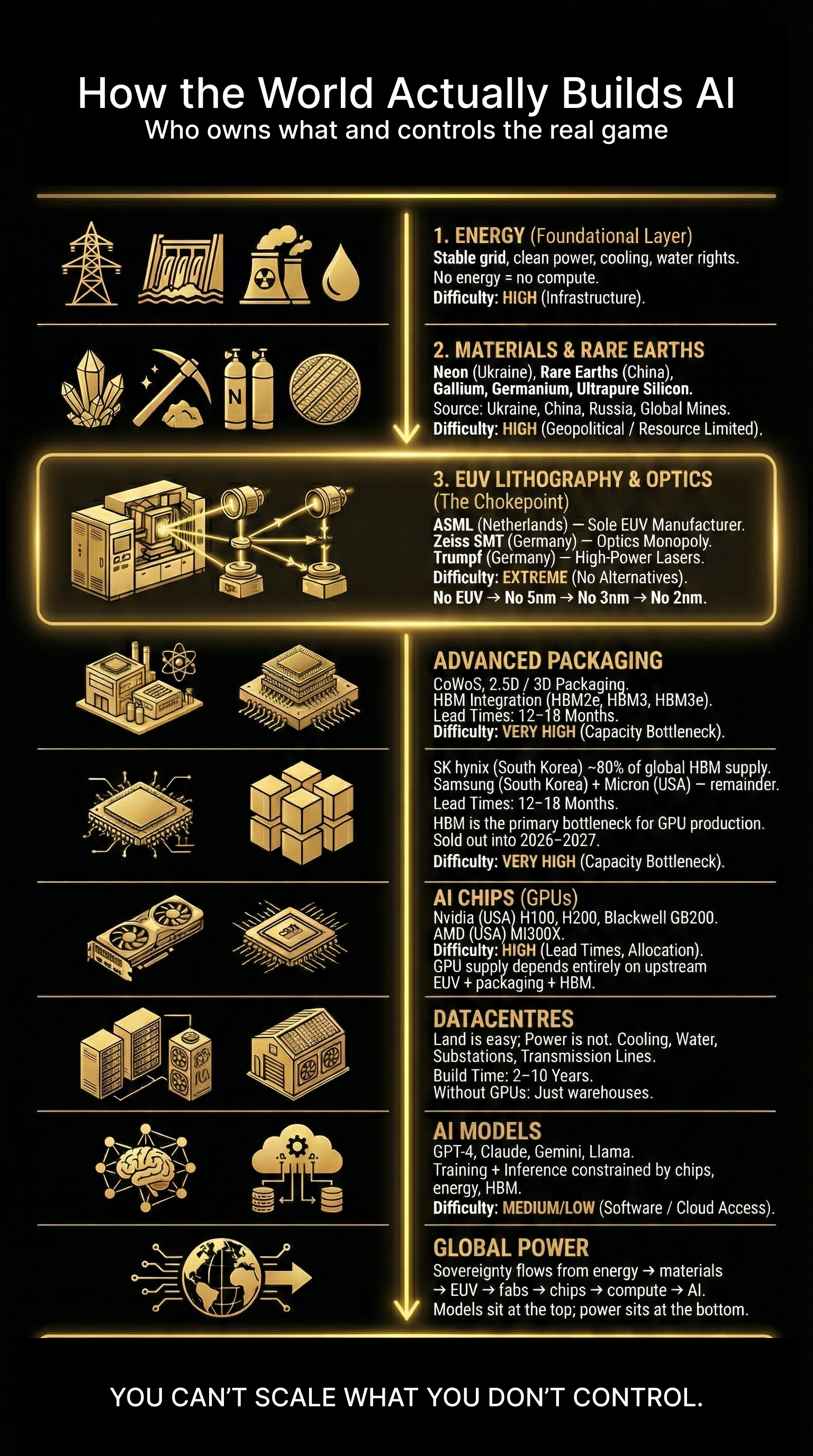

Most people imagine the AI stack like this:

Nvidia → GPUs → Datacentres → Models

The real stack looks like this:

Energy → Materials → EUV → Fabs → Chips → Packaging → GPUs → Datacentres → Models → Global Power

Each layer narrows. Each layer slows. Each layer consolidates. By the time you reach EUV, you’re dealing with a handful of European firms that quietly define the pace of the entire global AI economy.

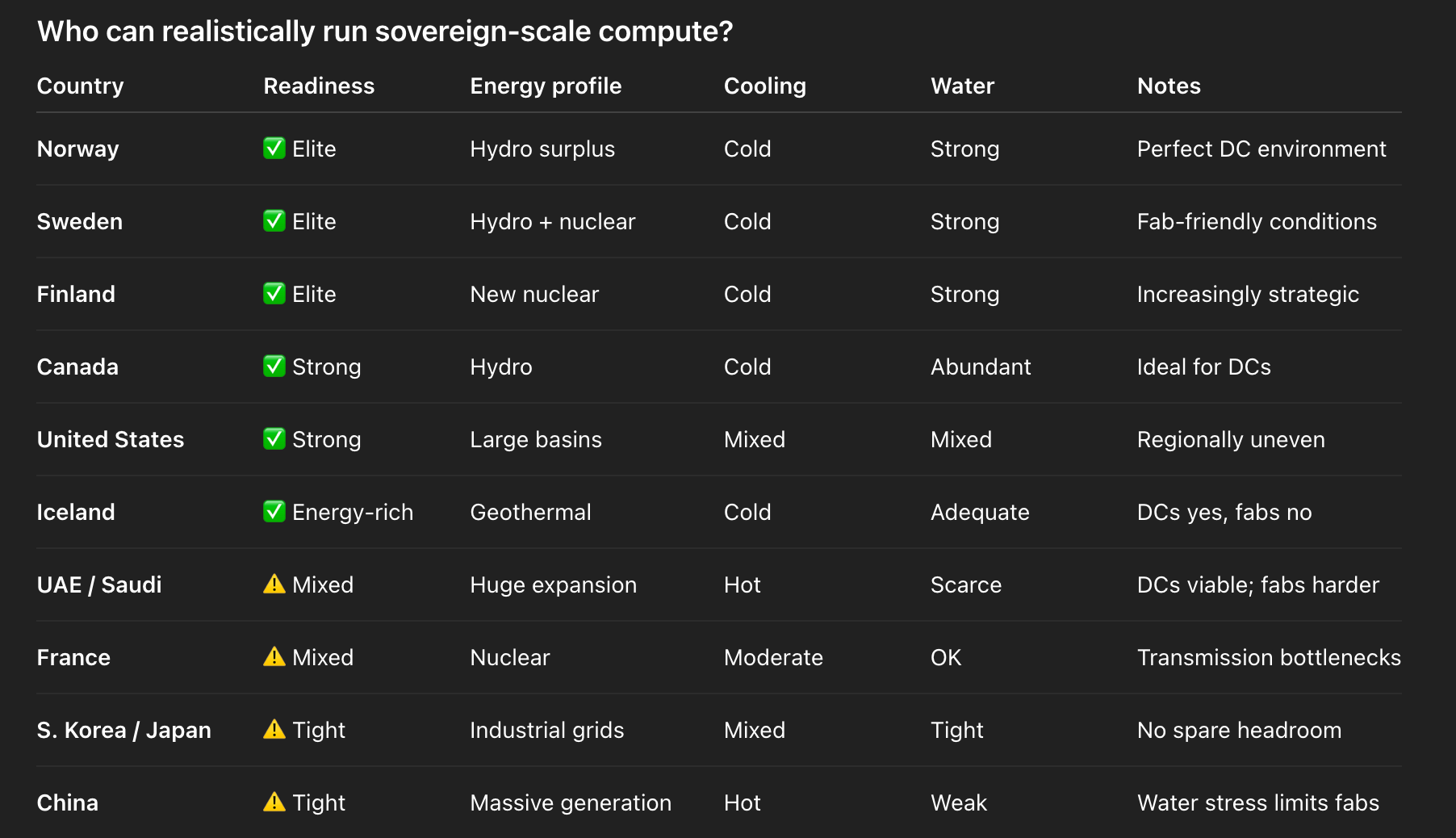

2. Energy — The First Filter of Sovereignty

Forget models. Forget GPUs. If you don’t have energy, you don’t have compute. And not just “cheap electricity.” You need a stable grid, modern transmission, ideal cooling conditions, and secure water rights. Most countries fail the test before they’ve even begun.

If a country fails the energy test, it fails the sovereignty test. End of story.

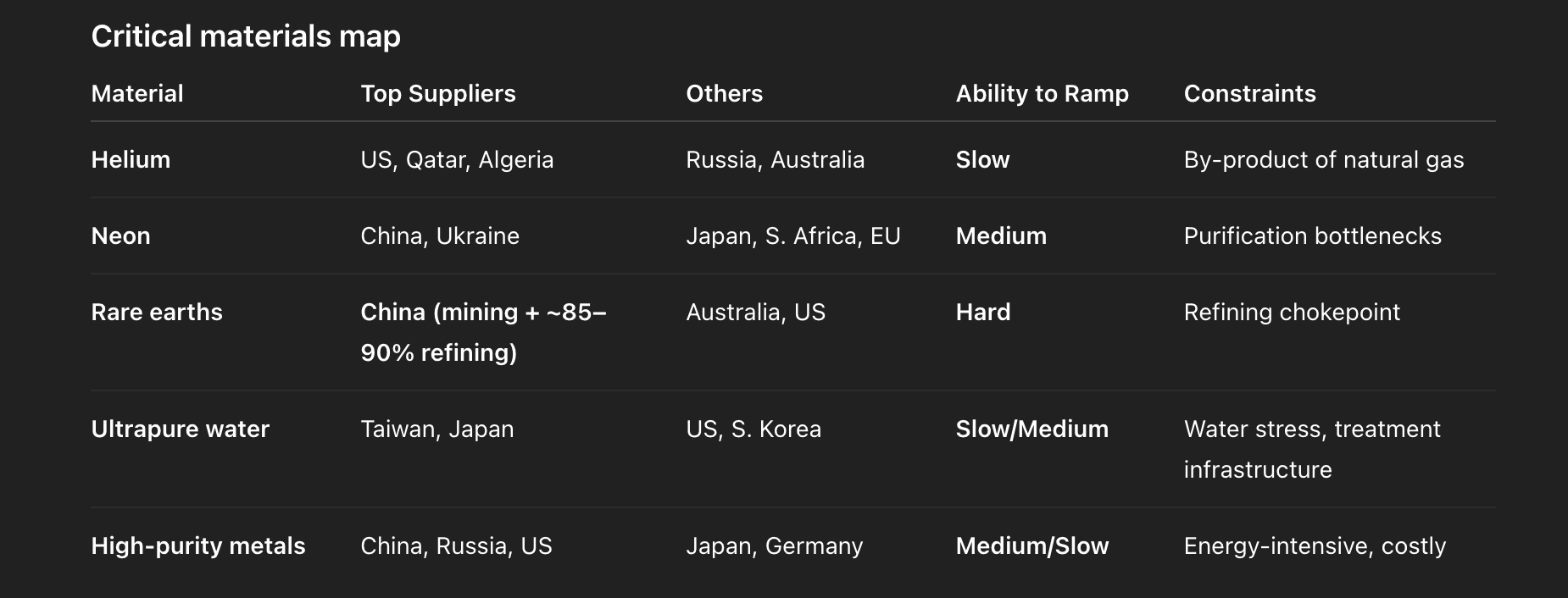

3. Materials — The Part Everyone Forgets

Even with energy, you still need gases, metals and ultrapure inputs dominated by a tiny number of nations.

A war in Ukraine? Neon evaporates → EUV output drops → TSMC slows → Nvidia shipments dip → your AI roadmap slips months. This isn’t theory. This is how tightly integrated the system is.

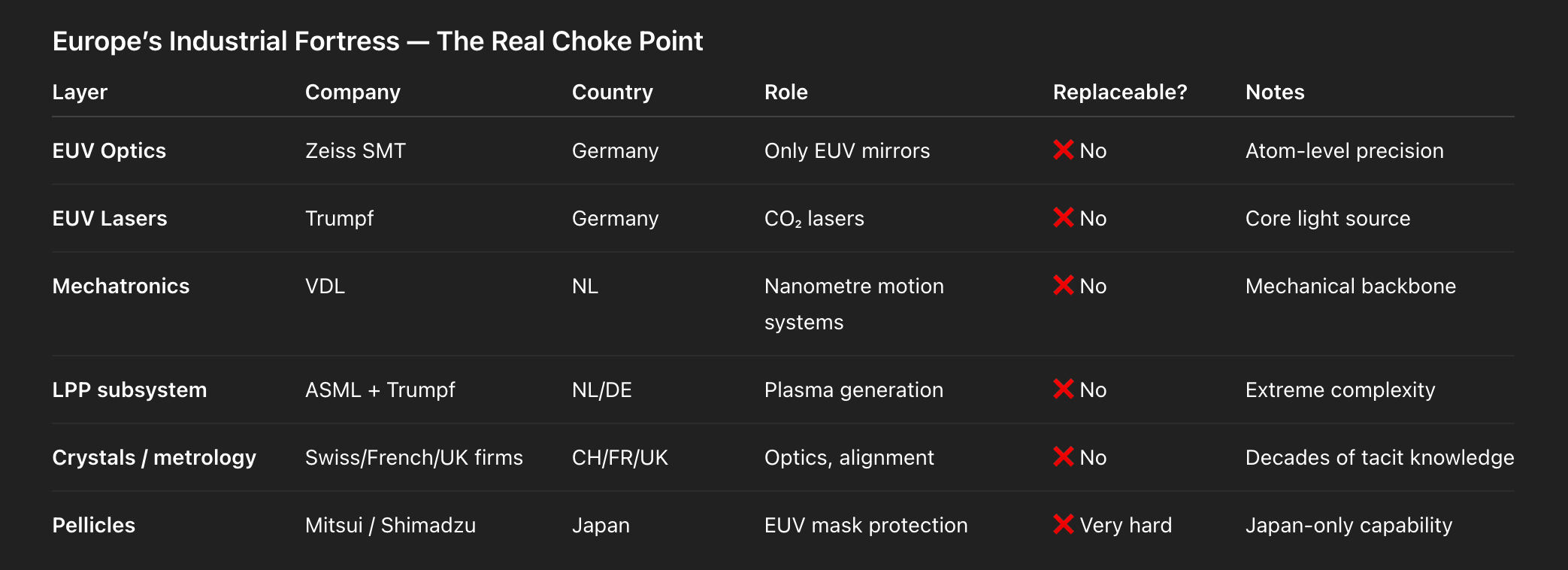

4. EUV — Europe’s Emperor of Compute

Now we hit the first true choke point. Only one company on Earth builds EUV lithography machines: ASML (Netherlands) [1].

No EUV → no 5nm → no 3nm → no 2nm No advanced chips → no GPUs No GPUs → no frontier models No frontier models → no sovereign AI

But the real story sits underneath. ASML is not a standalone monopoly. It sits atop a European industrial fortress that no one else can replicate.

This ecosystem is locked through joint IP, co-development, exclusive agreements, and decades of tacit knowledge. There is no second source for any of it. If even one of these firms stops? The global AI industry stalls at the Dutch–German border. This is the part Silicon Valley never talks about.

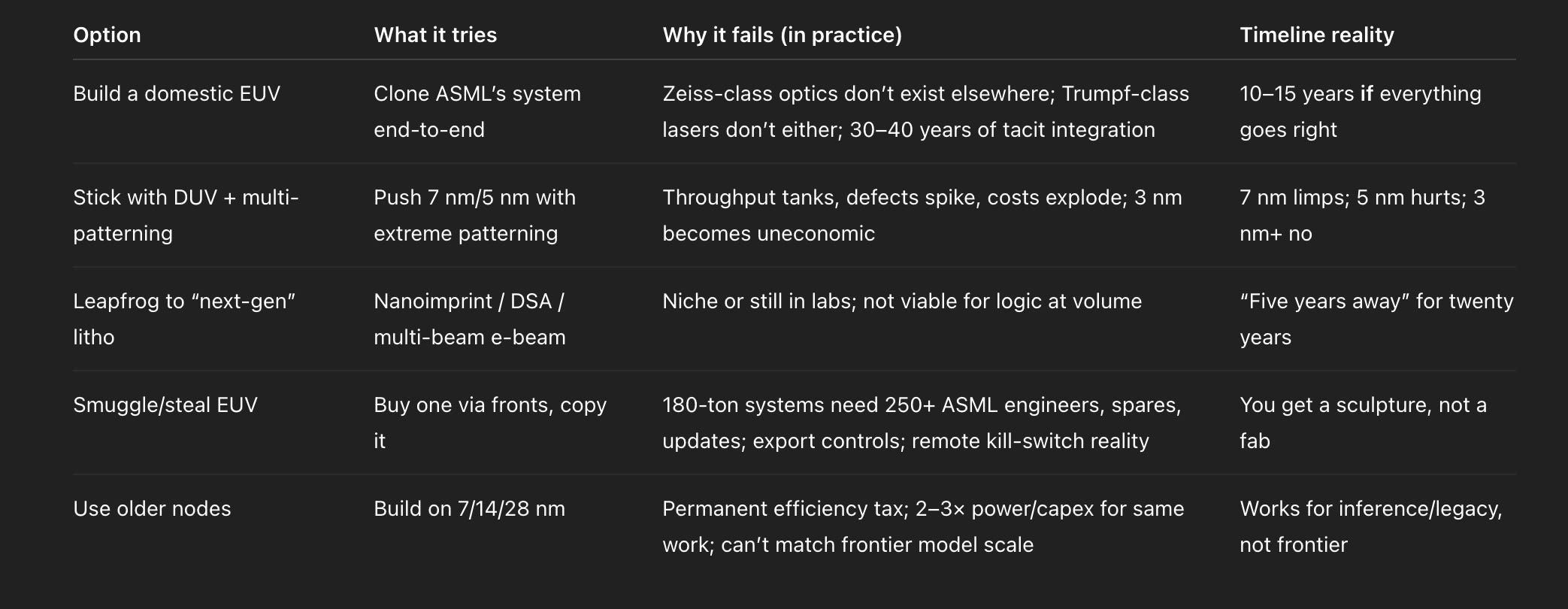

4a) Can Anyone Work Around ASML? (Short answer: no, not on a useful timeline)

Every “workaround” collapses under physics, yield, or time.

Net: you can buy time at older nodes; you can’t buy sovereignty at advanced nodes without EUV + the European cluster. There is no shortcut. Only the Hague’s licence clock.

4b) Quantum Won’t Break the Moat (it adds to classical demand)

Quantum complements; it doesn’t replace.

For the next 15–20 years, useful systems are hybrid: quantum accelerators + lots of classical control and error-correction silicon.

Why ASML’s moat survives:

Quantum chips still come from fabs. Superconducting, silicon-spin, photonic and ion-trap devices all ride CMOS toolchains. The control planes are heavily lithography-intensive.

Scale needs classical. Even if you have qubits, error correction, I/O and scheduling live on advanced nodes. That’s more wafers, not fewer.

Timeline favours incumbents. 2025–2035 = narrow quantum advantage in niches (chemistry/optimisation). Datacentres, AI training, edge compute remain classical-dominant.

Capital flywheel. ASML’s EUV profits fund High-NA and whatever comes next. The monopoly bootstraps the next monopoly.

Bottom line: quantum adds a layer to the stack; it doesn’t delete the European gate at EUV. Welcome to the future—still gated by Dutch paperwork.

Objections I can already hear

“The US writes the export rules.”

Washington is loud; Dutch/EU licensing is the gate. No Dutch licence → no shipment. US pressure shapes scope; NL paperwork stops the crate.

“Intel 18A fixes the TSMC dependence.”

Good progress, yes. It adds capacity at the margin; it doesn’t remove the EUV dependency or the Zeiss/Trumpf optics/laser choke.

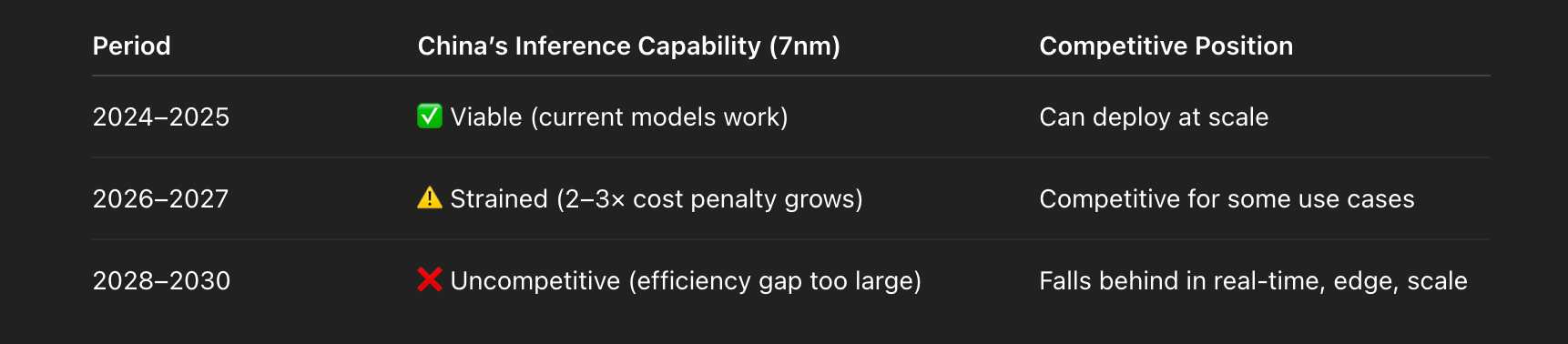

“China’s already at 7 nm; they’ll catch up.”

7 nm on DUV works with yield/throughput penalties. 5 nm is painful; 3 nm is uneconomic without EUV. Scale loses to physics.

“Japan’s Rapidus changes the game.”

Welcome capacity (2027+), still EUV-gated and tool-chain-limited. It diversifies geography; it doesn’t dissolve Europe’s choke.

“New lithography will leapfrog EUV.”

Not for logic at volume. Everything credible still needs the EUV ecosystem for critical layers or pre-patterning.

“China can pull rare earths and win.”

Materials leverage is real; it slows the world. It doesn’t conjure EUV optics or lasers. Minerals ≠ mirrors.

And the biggest objection

The Inference Objection—And Why It Doesn’t Hold

“But Inference Runs Fine on Older Chips, Right?”

This is the objection you’ll hear: “China doesn’t need EUV to deploy AI. Inference works on 7nm chips. They can license or copy trained models and run them domestically. The EUV chokepoint only matters for training.”

It’s partially true today—and misleading about tomorrow.

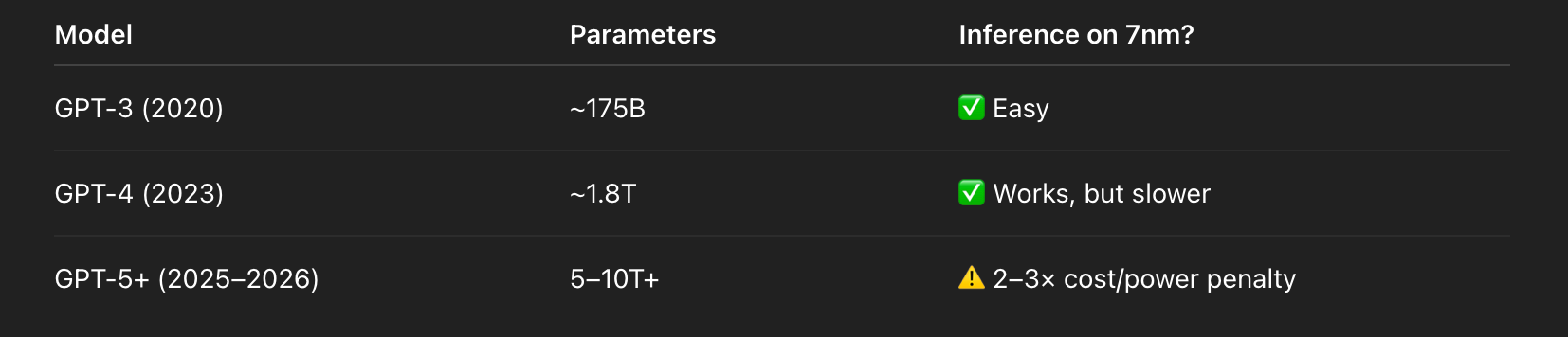

What’s True: Inference Works on Older Nodes (For Now)

Current frontier models—GPT-4, Claude 3.5, Gemini—run inference workloads on 7nm, 14nm, even 28nm chips without major issues. Training requires cutting-edge hardware because it’s compute-intensive and runs for months. Inference is lighter-weight: milliseconds per query, spread across billions of requests.

Real-world proof:

Meta runs inference on mixed 7nm/14nm infrastructure

AWS Inferentia (7nm) handles massive inference loads

China’s Baidu, Alibaba, ByteDance deploy AI on domestic 7nm chips

The objection stands: Right now, you can deploy AI at scale without EUV. The 7nm ceiling doesn’t block operational AI in 2024–2025.

But this window is closing.

Why Advanced Nodes Are Becoming Critical for Inference

Three forces are driving inference toward cutting-edge chips:

1. Models Are Growing Exponentially

Running a 10T parameter model on 7nm means 2–3× higher power consumption, slower responses, and ballooning infrastructure costs. At billion-query scale, that’s hundreds of millions in wasted spend.

2. Real-Time Applications Demand Low Latency

Elon Musk’s Tesla example is the tell: Tesla’s Full Self-Driving hardware (14nm) is struggling with next-gen neural networks. The next chip (HW4) is moving to 5nm—not for training, but for real-time inference in cars.

If autonomous vehicles need advanced nodes, so will:

Robotics (humanoid robots, warehouse automation)

AR/VR (Apple Vision Pro, Meta Quest)

Edge AI (phones, drones, IoT devices)

Inference was “fine on old nodes” when models were small and latency didn’t matter. As AI moves into real-time, power-constrained applications, advanced nodes become mandatory.

3. Datacenter Economics Favor Efficiency at Scale

At billion-query scale, the efficiency difference between 7nm and 3nm isn’t marginal—it’s 50% lower power, 50% fewer chips, 50% lower cooling costs. Over three years, that’s $250M+ in savings for a large deployment.

Companies running inference on 7nm can compete—but at a permanent cost disadvantage that compounds as models scale.

The Timeline: When Does 7nm Stop Being “Good Enough”?

China has a 2–3 year window where 7nm inference is “good enough.” After that, the efficiency gap becomes a strategic handicap.

The Verdict: Europe’s Leverage Extends to Inference Too

The inference objection doesn’t weaken the argument—it adds a timeline:

Training: EUV leverage is immediate (always true)

Inference: EUV leverage is delayed but inevitable (2–3 year window closing)

Real-time/Edge AI: EUV leverage is already here (Tesla, robotics, AR/VR)

By 2026–2028, the 7nm ceiling will constrain not just innovation (training), but deployment (inference) at competitive cost, latency, and power efficiency.

Europe doesn’t just control who can push the AI frontier. It controls who can scale it economically.

5. Fabs — Where Physics Sets the Pace

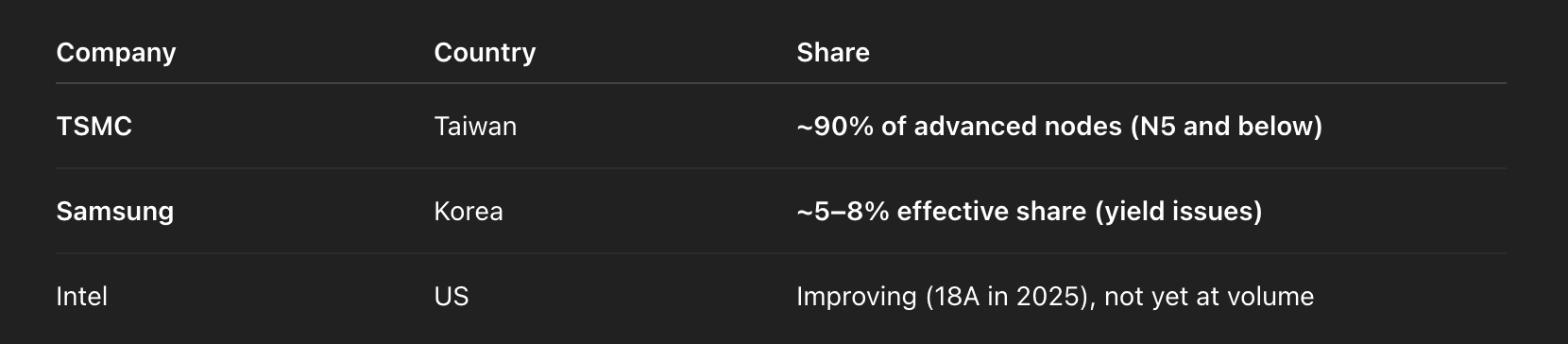

Even with EUV, you still need fabs that can run it. A modern fab costs $20–40B, takes 3–7 years to build, and consumes energy and water like a city [4]. Only three companies can run leading-edge fabs:

And TSMC? It is already at or near 100% utilisation across its advanced nodes (5nm and below) [6]. There is no slack. No “extra” lines. No emergency capacity. Chip supply is physically capped.

This concentration creates a geopolitical single point of failure. A Chinese blockade of Taiwan would halt 90% of advanced chip production overnight. The US CHIPS Act’s $52B is better understood as insurance than replacement—replicating TSMC’s 30-year learning curve will take a decade minimum, if it succeeds at all. This is why European control of EUV matters: even if fabs diversify geographically, they all still need Dutch permission to exist.

6. Chips — Where Yield, Packaging & Memory Decide Everything

Most people think “more wafers = more chips.” Wrong. The three chokepoints are yield at 3nm/5nm, advanced packaging, and high-bandwidth memory (HBM).

Packaging (CoWoS, 2.5D, 3D) is now as constrained as fabs, with 12–18 month waits as Nvidia pre-books the majority of capacity [7]. Meanwhile, HBM is now the primary bottleneck for GPU availability, with key suppliers like SK hynix reportedly sold out for years.

7. GPUs — Allocation, Not Availability

GPUs are the visible symbol of the AI race. But behind them sits a three-way bind: TSMC wafers → packaging → HBM → Nvidia boards → your datacentre. If any link slows, everything slows.

As of late 2024, lead times remain long. Nvidia’s next-generation Blackwell GPUs are reportedly sold out through 2025, and while H100 availability has improved, securing large-scale clusters remains a challenge. The mantra “just buy more GPUs” really means: “hope the entire semiconductor chain had spare capacity two years ago.” It didn’t.

Your cap table is your story of ownership. Get it wrong, and you’ll lose more than equity — you’ll lose leverage.

In this live workshop with Antoine Bruna (CEO, Capquest), we’ll clean up the chaos and show you how to model dilution, vesting and exits in plain English.

What we’ll cover:

How to structure a clean, investor-ready cap table (and fix messy ones).

Understanding vesting, option pools, and founder dilution — what they mean in real terms.

Modelling waterfall scenarios so you know who actually gets what at each stage or exit.

Common founder mistakes that destroy leverage — and how to avoid them.

How Capquest automates all of it: equity tracking, updates, vesting schedules, and round planning, so you’re always due-diligence ready.

What you’ll get:

A clearer view of your ownership journey, practical steps to protect it, and a free Capquest account to start modelling your own cap table. Use the code F42START

For the ❤️ of Startups

8. Datacentres — Warehouses Without Hardware

Land is easy. Power is not. Cooling is a tax. Water is a limit. And transmission is the killer. Substations take 2–5 years to build; transmission upgrades take 3–10. A datacentre without GPUs is a warehouse. A rack without HBM is dead metal. A GPU without chips is a purchase order. The constraints live upstream.

9. AI Models — The Glamour Layer

GPT. Claude. Gemini. Llama. All impressive. But models don’t create sovereignty. They consume it. Your AI capability is bounded by wafer allocation, GPU lead times, export controls, grid capacity, and, ultimately, ASML’s delivery schedule. Models sit at the top. Power sits at the bottom.

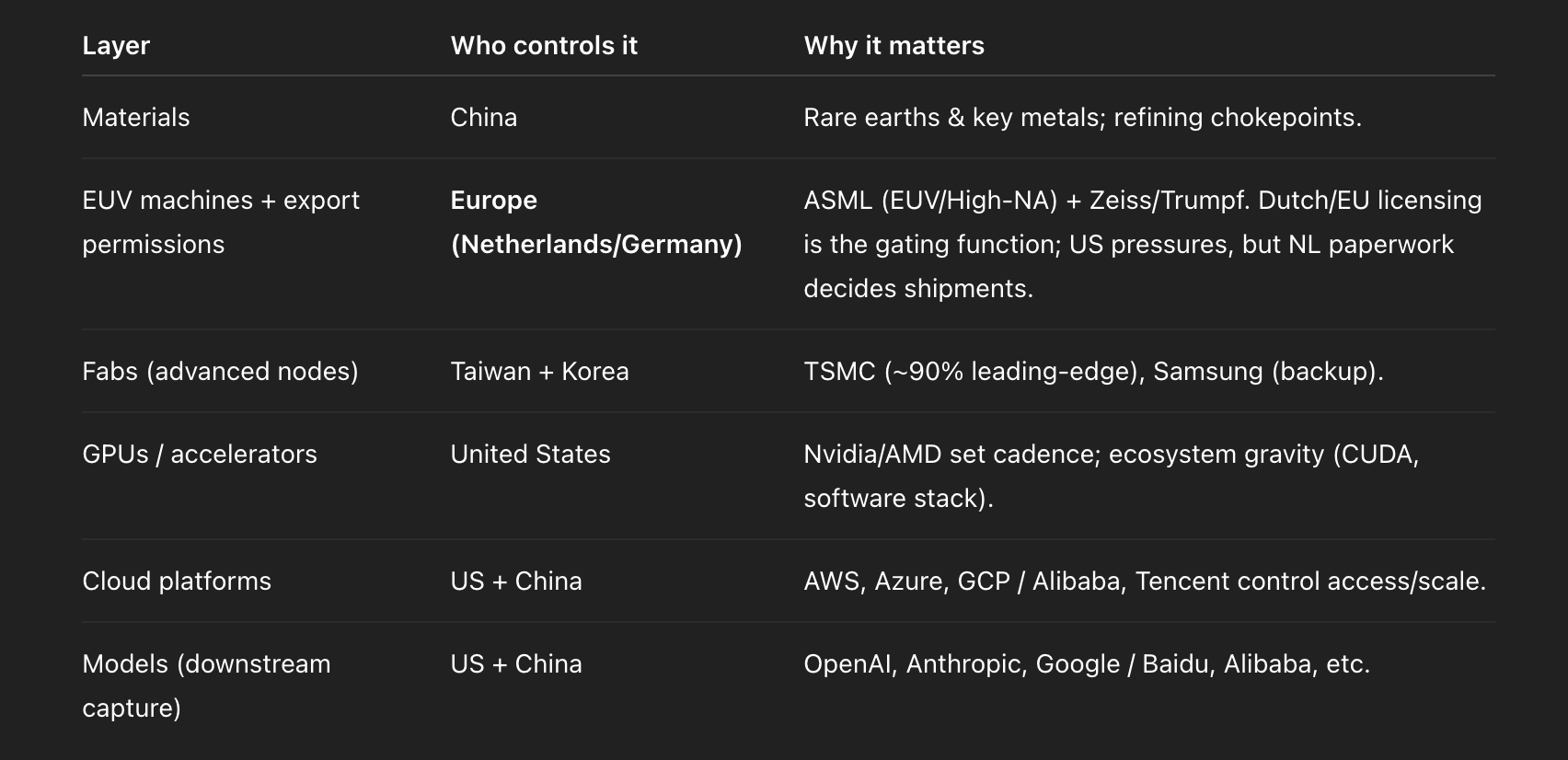

10. So Who Actually Controls AI?

Strip away the hype. The power is distributed in a clear hierarchy.

11. The Hard Truth

AI isn’t a software race. It’s a supply-chain contest.

The hierarchy is clear: materials → machines → fabs → chips → compute → AI → global leverage.

Europe controls the machines. Taiwan controls the fabs. The US controls the cloud and the software ecosystem. China controls the minerals.

Everyone else rents sovereignty.

This isn’t about ambition. It’s about physics, engineering, and who owns the bottlenecks. And the most critical lever—the one that determines who can even build a modern fab—is not held in Washington or Beijing, but in The Hague.

Welcome to Europe — where your AI desires and FOMO are controlled.

References

[1] ASML is the world’s sole supplier of EUV lithography machines, a fact widely reported by financial news outlets and confirmed in the company’s own statements.

[2] Zeiss SMT’s exclusive role as the supplier of EUV optics is documented in numerous industry analyses and reports on the semiconductor supply chain.

[3] Trumpf’s role in providing the high-powered CO₂ lasers for ASML’s EUV systems is a key part of the established EUV ecosystem.

[4] Fab construction costs are regularly cited by industry analysis firms like SEMI and consulting groups such as BCG.

[5] TSMC’s ~90% market share in advanced semiconductor manufacturing (sub-7nm) is a widely cited statistic from market research firms like TrendForce and in reports from geopolitical think tanks like CSIS.

[6] Information on TSMC’s capacity utilization is derived from its quarterly earnings reports and analysis by semiconductor industry watchers.

[7] Lead times for CoWoS and other advanced packaging are reported by industry trade publications such as Digitimes, based on supplier and customer reports.

[8] The Dutch government’s authority over ASML export licenses has been the subject of official government announcements and extensive reporting by outlets like Reuters and Bloomberg.

Thank you for reading. If you liked it, share it with your friends, colleagues and everyone interested in the startup Investor ecosystem.

If you've got suggestions, an article, research, your tech stack, or a job listing you want featured, just let me know! I'm keen to include it in the upcoming edition.

Please let me know what you think of it, love a feedback loop 🙏🏼

🛑 Get a different job.

Subscribe below and follow me on LinkedIn or Twitter to never miss an update.

For the ❤️ of startups

✌🏼 & 💙

Derek