Since we began, we’ve mapped over 900 funds raising $280 billion⁺ in fresh capital—so money isn’t the problem. The real challenge? Mobilising the investors.

We’re stepping up: the New Funds dataset is migrating to F42+ membership. That means smarter breakdowns, cleaner access, and deeper insights into capital deployment. But don’t worry—the Raise Report still lands weekly, delivering the market signal with extra value baked in.

This week’s focus: Athlete investors—who they are, what they’re backing, and how that matters for founders raising now.

GLOBAL SUPER ACCELERATOR II IS NOW OPEN FOR APPLICATIONS

8-Week Execution and AI-First Accelerator

Panels: Rapid-fire operator & investor insights for clarity.

Master Classes: Battle-tested frameworks powering AI execution.

Workshops: Hands-on sprints that ship real builds.

Programme Kicks Off 25th Sept.

💸 New Funds Looking to Give You Cash 🚀 $22.1B Across 63 New Funds

AI, life sciences, and dual-use defence dominate this cohort, with climate, fintech and crypto taking smaller, targeted slices.

Where the Money is Going

🌍 Geography at a Glance

Middle East & Africa (46.6% of fund $) – Sovereign-scale AI capital leads the pack, with seed pools building out creator-economy and fintech rails.

Asia-Pacific (25.9%) – ANZ mega-funds and state-backed programmes in Korea/India push early-stage cheques; climate and AI are front and centre.

North America (20.9%) – Life sciences and defence-oriented vehicles dominate, alongside university/regionals energising seed.

Europe (4.2%) – Climate, female-led and Italy-focused early funds active; a large defence-tech pool is forming.

Rest of the World (2.4%) – Global co-investment and crypto fund-of-funds add niche dry powder.

🎯 Sector Priorities

AI (57.0% of funds by $)

Investors are backing sovereign-scale AI programmes plus seed vehicles for AI-native apps, talent and infrastructure.

Biotech & Health (25.6%)

Heavy focus on company creation, therapeutics and medtech; specialised pots (e.g., women’s health, translational labs) are well represented.

Defence & Space (6.2%)

Dual-use, cyber, space and autonomy themes are in favour, often with government-adjacent demand.

Generalist (6.1%)

Regional and university-targeted funds supporting local founders across software, consumer and industrial tech.

Other Sectors (5.1%) – Climate & energy (decarbonisation and project seed), fintech (credit-union-driven innovation) and crypto/Web3 (infrastructure and managers).

🚀 Investment Stages

Early Stage — 77.8% of new funds (49 of 63)

Pre-seed to Series A dominates: company-creation models, university spinouts and regional seed platforms.

Growth Stage — 19.1% of new funds (12 of 63)

Larger pools for scaling defence/AI, life-sciences follow-ons and venture debt.

What This Means for Founders

Capital is concentrating in the Middle East & Africa (driven by AI) while Asia-Pacific and North America remain the most active for execution-ready cheques; the hottest sector is AI, with substantial depth in biotech/health and dual-use defence. If you’re raising now, anchor your story to clear AI leverage or clinical/dual-use milestones, map targets by region (MEA for mega-cheques; ANZ/US for active early leads), and prioritise funds signalling hands-on company-building at seed.

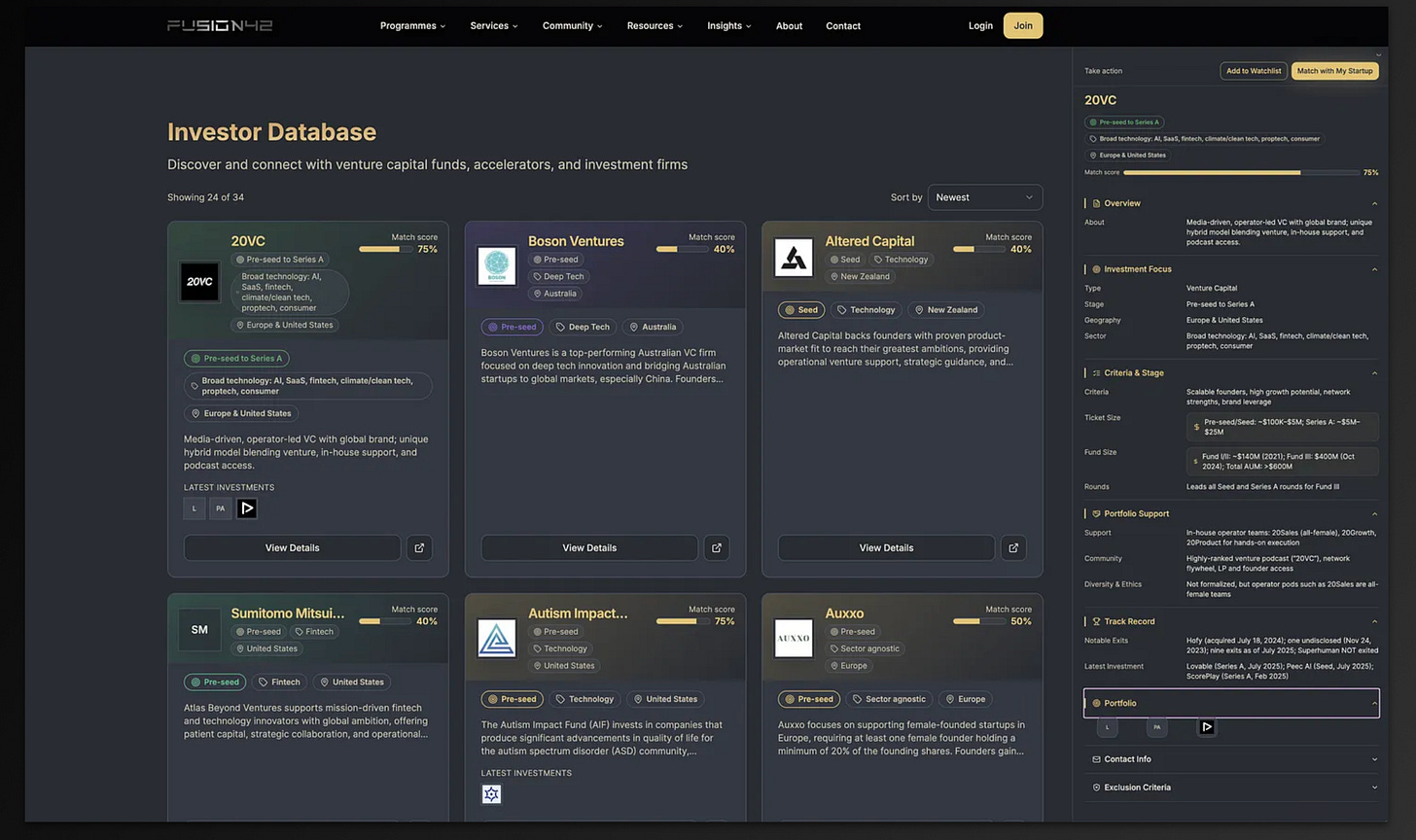

🔎 The Investor Database

We’re not just listing funds — we’re breaking them down into decision-ready intelligence.

Each new entry is structured across multiple layers:

Fund Basics — who they are, when they launched, and where they operate.

Fund Size & Cheques — capital committed and the ranges you can realistically expect.

Focus & Criteria — the sectors, stages, and geographies they actually back.

Support & Differentiation — how they work with founders, from portfolio support to networks.

Key Contacts & Investments — lead partners, latest deals, and notable exits.

Extra Value Research — founder feedback, follow-on strategies, red flags, and more.

This structure gives you critical insight beyond the headline number — not just who raised, but how they invest, what they signal, and what founders need to know before making contact.

The new VCs aren't on Sand Hill Road—they're on the NBA court and the World Cup pitch.

Athletes like Serena Williams, LeBron James, and Joe Montana are now writing the first checks for tomorrow's unicorns. But this is more than celebrity money; it's strategic capital that can put your startup on the global map.

We've built the ultimate founder's guide to 25 of the most active athlete investors, complete with their funds, focus areas, and website for contact.