GLOBAL SUPER ACCELERATOR II IS NOW OPEN FOR APPLICATIONS

8-Week Execution and AI-First Accelerator

Panels: Rapid-fire operator and investor insights — so you make sharper decisions, faster.

Masterclasses: Battle-tested frameworks — so you can execute AI strategies with confidence.

Workshops: Hands-on sprints — so you leave with real builds, not just ideas.

Programme Kicks Off 25th Sept.

In the last 12 months, we’ve tracked 830 new funds that have raised $260B in new VC firepower — and the real challenge isn’t raising it, it’s getting investors to part with it.

Here’s where the money is moving now.

🌍 Top 20 Global Startup Cities 2025 — Who’s Leading, Who’s Rising

The latest global startup ecosystem rankings are here, and while San Francisco still dominates, the real story is momentum.

These rankings are based on Total Score — a composite measure of startup quantity, quality, funding, infrastructure, and business environment — plus Annual Growth Rates, which show how fast each ecosystem is evolving.

2025 Top 20 Global Startup Cities

Leaders by Total Score:

1️⃣ 🇺🇸 San Francisco — 852.6 — +19.9%

2️⃣ 🇺🇸 New York — 315.5 — +25.5%

3️⃣ 🇬🇧 London — 187.3 — +29.8%

4️⃣ 🇺🇸 Los Angeles — 139.1 — +14.1%

5️⃣ 🇨🇳 Beijing — 137.0 — +25.2%

Biggest Momentum in the Top 20:

🚀 🇸🇬 Singapore — +50% growth

🚀 🇨🇳 Shanghai — +38.4% growth

🚀 🇫🇷 Paris — +34.6% growth

🚀 🇮🇳 Mumbai — +31.5% growth

🚀 🇰🇷 Seoul — +30%+ growth

Middle East Movers to Watch

Neither 🇦🇪 Dubai nor 🇸🇦 Riyadh cracked the Top 20 yet — but both are surging.

Riyadh ranks 23rd globally after a 60-place jump in just three years.

Dubai holds 44th, growing +33% YoY, the fastest in the Arab world.

Both are becoming MENA powerhouses through targeted policy, VC growth, and strong performance in sectors like fintech, AI, and smart cities.

Why It Matters

Total Score shows scale — but growth rate signals where the next global leaders will emerge. Cities like Singapore, Shanghai, and Riyadh are proving that focus, policy, and capital can close the gap faster than ever before.

💡 If you’re a founder — consider where momentum aligns with your market.

💡 If you’re an investor — watch the risers; they often offer better entry points before valuations peak.

📊 Micro takeaway:

London’s 29.8% YoY growth now outpaces New York — Europe’s clearest signal for founders chasing capital and talent.

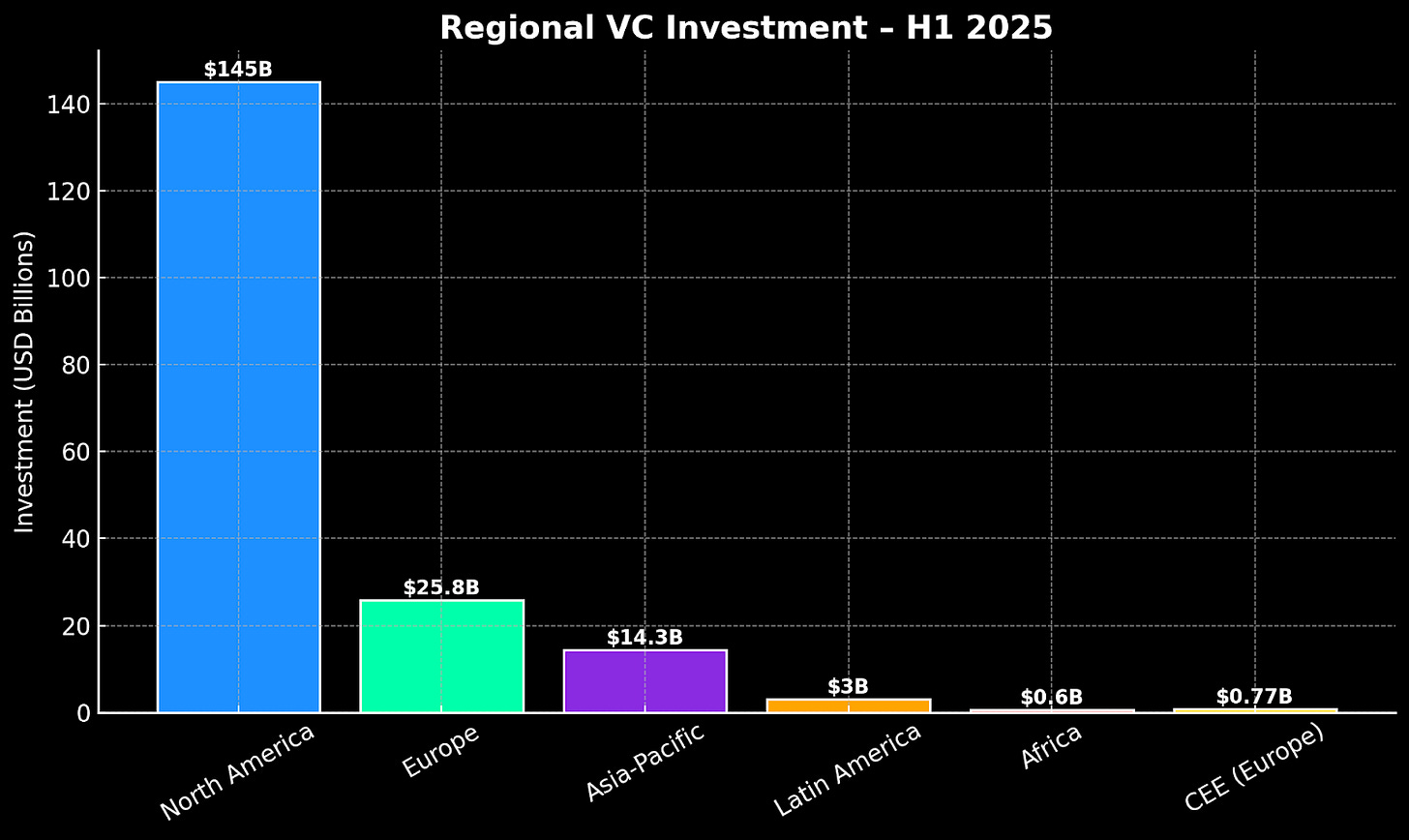

Regional VC Investment (H1 2025)

Global VC Flows Reshape in H1 2025

Venture capital investment patterns are shifting sharply in the first half of 2025, with North America extending its dominance and AI soaking up unprecedented funding. Europe is seeing a power shift as Germany overtakes the UK, while Latin America and Africa post surprising new leaders in deal flow. Asia-Pacific remains mixed, with India and Singapore thriving despite China’s slowdown, and CEE wrestling with contracting deal volumes.

North America

$145B invested; 70% global share; AI ≈ $90B#

Strong IPO activity (Circle, Chime); mega-round dominance

Europe

$25.8B total; Germany overtakes UK for first time in a decade

Healthcare, biotech, AI lead; early & growth stage activity strong

Asia-Pacific

$14.3B; India & Singapore bright spots

China weak; geopolitical tensions dampen flows

Latin America

$3B; Mexico tops Brazil for first time since 2012

Shifting regional investment patterns

Africa

$0.6B; seed deal volume/value up 33%

FinTech, ClimateTech, AI dominate tech deals

CEE (Central & Eastern Europe)

$0.77B; deal volume down 23% YoY

Local funds constrained; EV growth continues

📊 Micro takeaway:

MENA’s 44% YoY growth is the fastest worldwide — early entrants can still claim mindshare before the market crowds.

VC Sector Trends (First 7 Months of 2025)

VC 2025: AI Grabs Spotlight as Sector Shifts Accelerate

Venture capital flows are surging into tech’s hottest growth engines, with AI absorbing nearly a quarter of all investment and driving mega-deals in infrastructure, enterprise, and large language models. Healthcare AI is seeing record growth on the back of regulatory wins, while DeepTech and Defense Tech are pulsing with investor interest. Climate Tech captures headlines but faces cooling deal momentum.

Meanwhile, legacy sectors like FinTech, Consumer Tech, and E-commerce are battling stiff headwinds—from sky-high acquisition costs to regulatory forces and post-pandemic resets. The pace of change is rapid, and winners are defined by agility and innovation.

Hot Sectors (Growth Leaders)

AI – 24.5% share; $280B+ invested; infra, enterprise & LLMs dominate

Healthcare AI – $31B; fastest growth, FDA approvals driving adoption

DeepTech – 12.2% share; quantum, robotics, advanced materials

Climate Tech – $13.2B; policy support but deal countdown 19% YoY

Cybersecurity – $4.9B; AI-driven security, geopolitical drivers

Defense Tech – $17.2B DoD R&D budget backing; dual-use innovation

Cooling Sectors (Under Pressure)

FinTech – 10.2% share; rebound from 2024 lows via DeFi & AI finance

Consumer Tech – High CAC, privacy regulation headwinds

E-commerce – Post-pandemic normalisation, B2B pivot focus

Traditional SaaS – Pricing pressure, AI disruption risk

Outliers – What’s Different in 2025

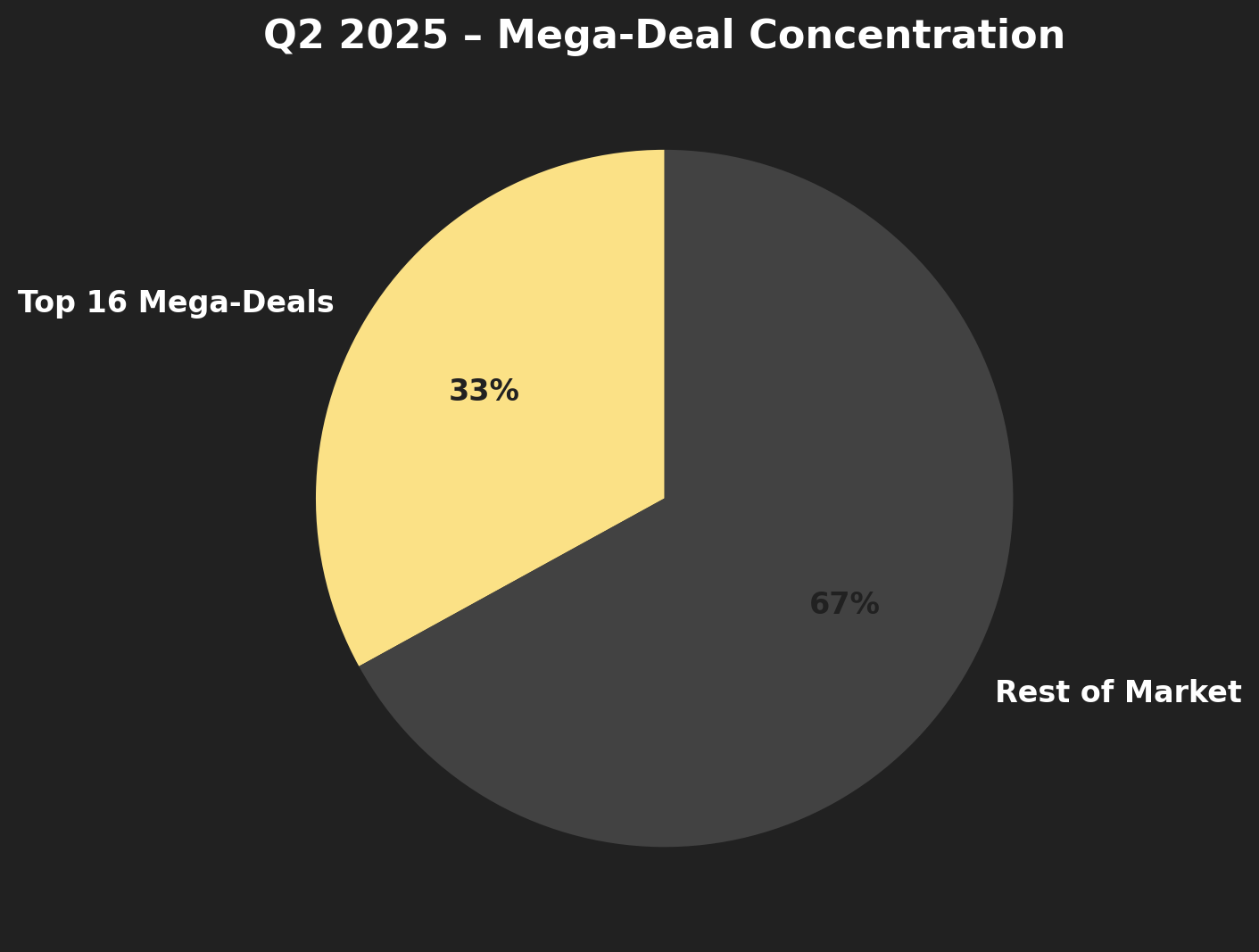

2025 VC Outliers: Mega-Deals, Unprecedented Velocity, and Market Shifts

A handful of giants now drive the venture landscape: just 16 companies soaked up a third of Q2’s funding, headlined by:

Mega-Deal Power Plays

⅓ of Q2 VC funding went to just 16 companies

OpenAI ($40B) – record‑setting deal

Scale AI ($14.3B),

xAI ($10B),

Thinking Machines Lab ($2B Seed) – record breakers by stage

AI Revenue Velocity

Lovable: fastest software company ever to hit $100M ARR, reaching that milestone in just 8 months from launch

Combined Lovable + Replit: climbed to $210M ARR in 8 months; Lovable at 1,250% MoM growth early on

Deal Count

Q2 2025: 6,028 deals (lowest since Q4 2016)

Structural Shifts

Heavy reliance on mega-rounds to prop up overall VC numbers

M&A boom: $100B+ in exits in H1 (+155% YoY)

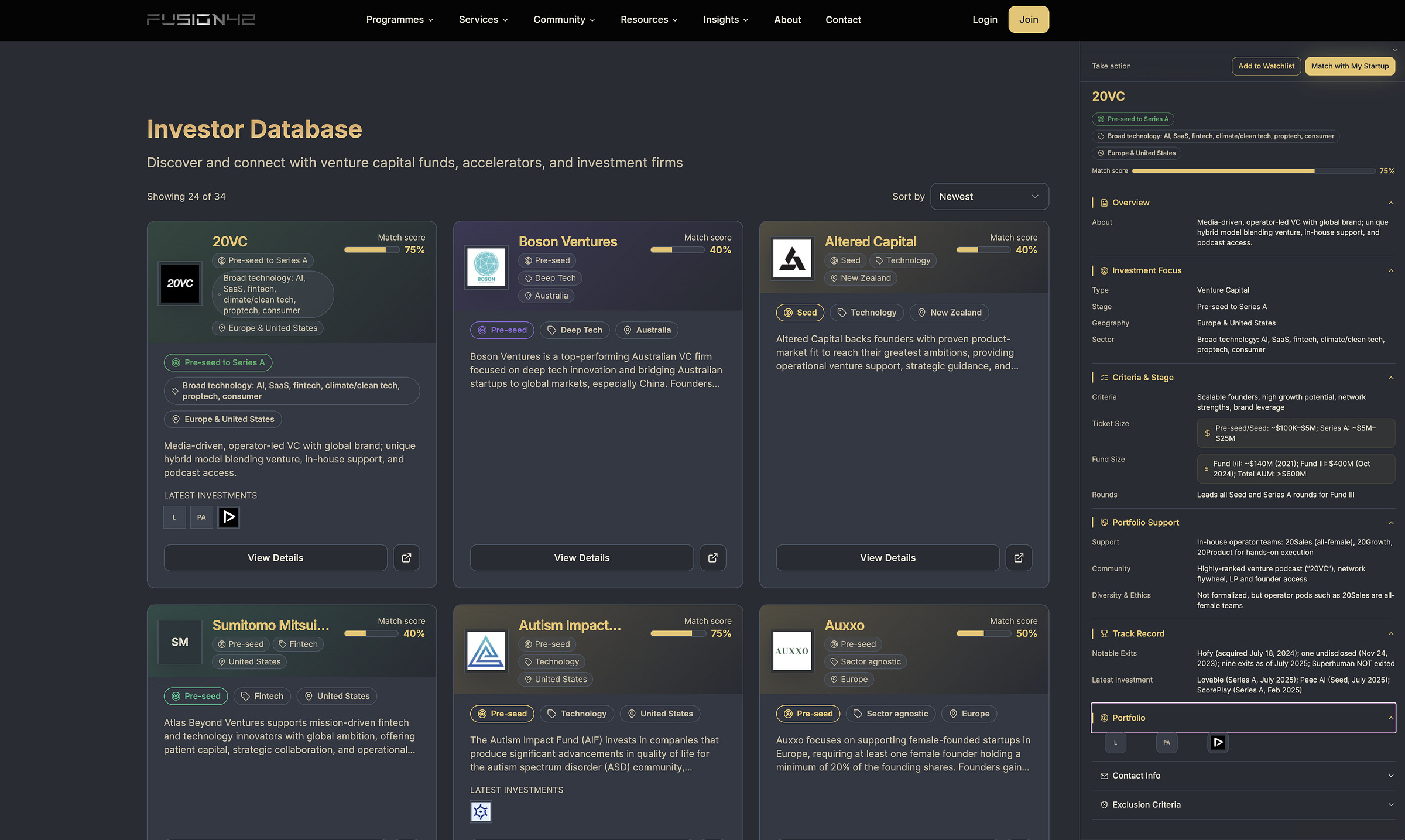

💰 Sneak Peek: The Fusion42 Funds Database for F42+ members.

Forget generic investor lists — this is fresh capital, ready to deploy.

What you’ll see:

Funds with New Mandates – Only those actively raising or freshly closed, with dry powder to spend.

Real Ticket Sizes & Stage Fit – Based on disclosed recent deals, not guesswork.

Deal Leadership Insight – Who leads, who follows, and how often.

Latest Investments – So you can time your outreach when they’re most active.

Portfolio Support Score – How much help they actually give post-cheque.

Exclusion Criteria – Avoid wasting time on funds that will never invest in your sector or model.

Coming Next:

We’re building out full team lists — verified LinkedIn profiles and direct emails for the decision-makers — so when this goes live, you’ll not only know who has capital… you’ll know exactly how to reach them.