⚙️ Why SaaS Metrics Fail for AI-Native Startups

🔧 It is like Using a Dipstick to Service a Tesla

🔥 In this piece:

🤖 What AI-Native Really Means

🧩 SaaS vs SaS: The New Foundation

📉 Why the Old SaaS Scoreboard Fails

📊 The New AI-Native Scorecard

🎯 Why This Matters for Founders & Investors

If you measure AI-native platforms with old SaaS KPIs, you’ll back the wrong founders and misprice the winners.

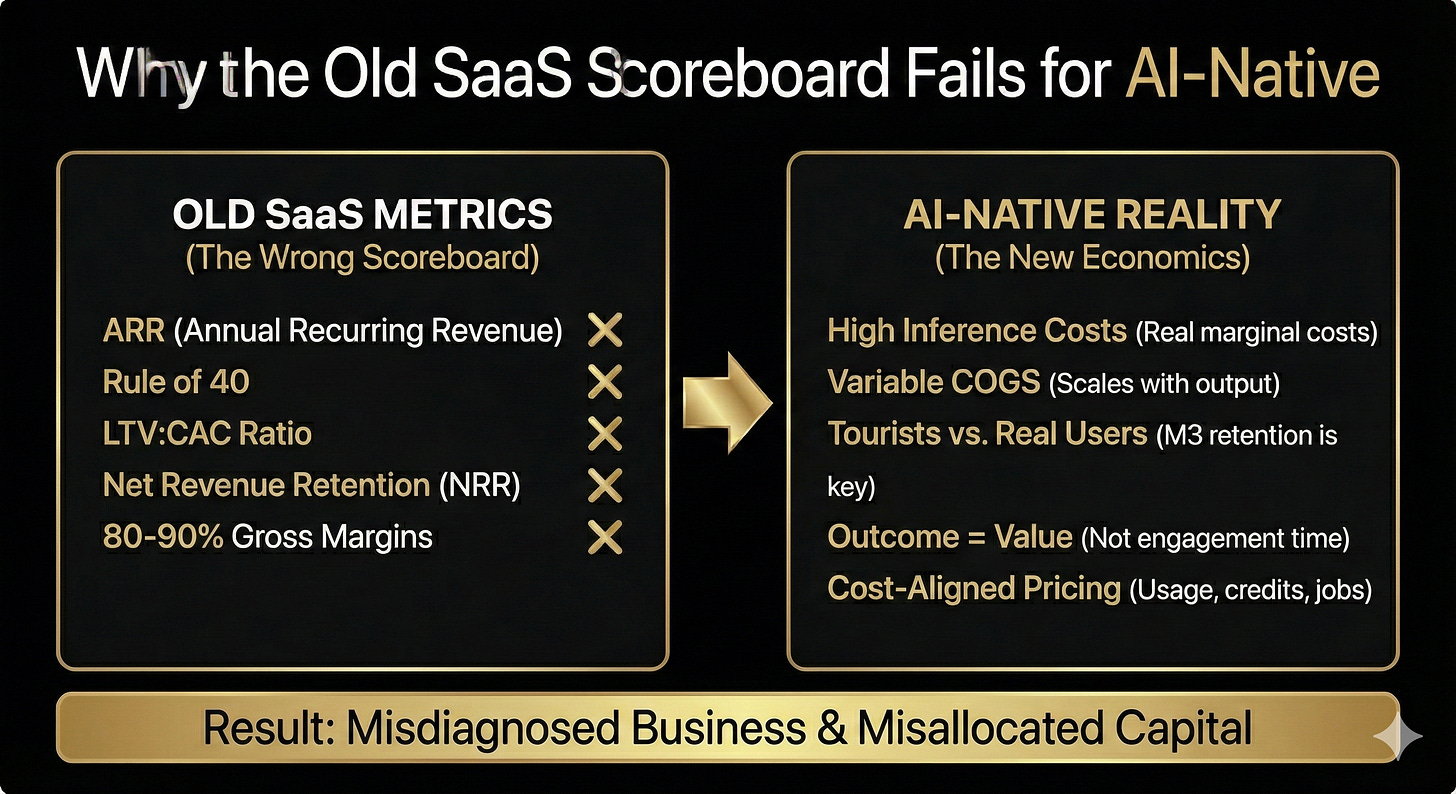

For anyone building or investing in the AI wave, one thing is now clear: if you evaluate AI-native companies using traditional SaaS metrics, you will misdiagnose the business, misunderstand the economics, and allocate capital in all the wrong places.

For twenty years, SaaS operated on a stable foundation. Software helped humans complete workflows. Pricing was per seat. Growth was linear. And the metrics were predictable: ARR, the Rule of 40, LTV:CAC, net retention, and those comforting 80–90% gross margins.

That model was correct for its era. It is not correct for this one.

A new class of company has emerged — Cursor, Lovable, Manus and others — and they do not behave like SaaS. They do not scale like SaaS. They do not retain users like SaaS. Their cost structure is nothing like SaaS.

These companies are AI-native.

Not “SaaS with an AI feature.”

Not “a wrapper on GPT-4.”

Not “we fine-tuned a model.”

AI-native is an entirely different product architecture — and therefore an entirely different economic system.

Yet the industry is still scoring them on the wrong scoreboard.

🤖 What AI-Native Really Means (Not What People Think)

Most people assume “AI-native” means building your own model, training your own LLM, or deploying proprietary architectures.

This is a misunderstanding.

AI-native = the AI does the work, not the human.

More precisely:

The AI is the operator.

The product delivers finished outputs, not workflow steps.

The unit of value is the completed job, not time spent in product.

Every unit of value carries a real inference cost.

The product cannot exist without the AI performing the work.

This has nothing to do with whether you use Claude, GPT-4, Llama, Mistral, or a hybrid router.

AI-native = outcome-producing, cost-bearing, value-generating systems.

Once you define it this way, the economics become obvious.

LISTEN TO THE DEEPDIVE PODCAST

Why SaaS Metrics Are Failing the Next Generation of Startups

This deep-dive episode breaks down why traditional SaaS metrics—ARR, NRR, LTV:CAC, per-seat pricing, and 80–90% margins—are dangerously misleading when applied to AI-native companies.

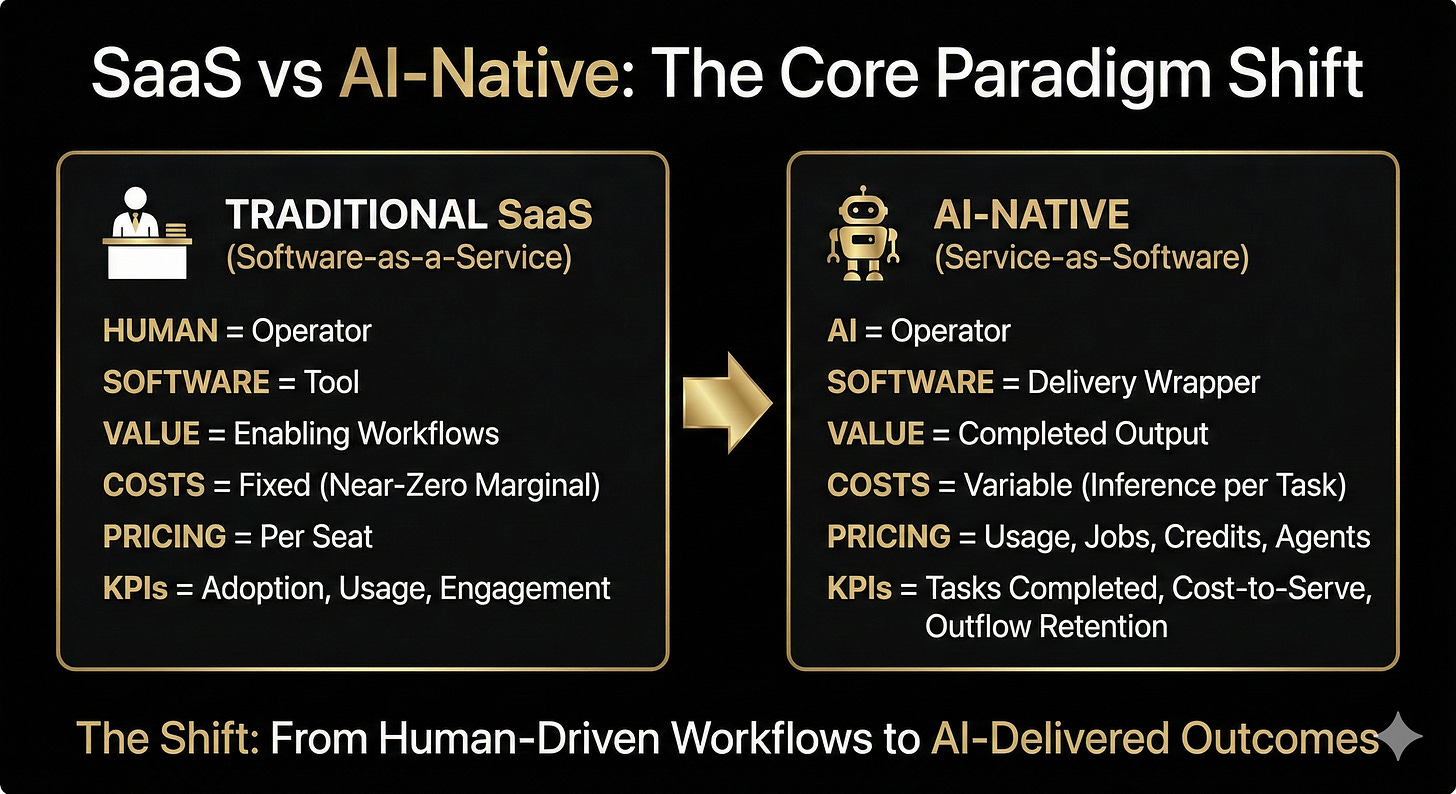

🧩 SaaS vs SaS: The New Foundation

Fusion42 and Investor-X use a distinction that is becoming foundational across the ecosystem:

SaaS — Software-as-a-Service

Human = operator

Software = tool

Value = enabling workflows

Costs = fixed, near-zero marginal cost

Pricing = per seat

KPIs = adoption, usage, engagement

SaS — Service-as-Software

AI = operator

Software = delivery wrapper

Value = completed output

Costs = variable (inference per task)

Pricing = usage, jobs, credits, agents

KPIs = tasks completed, cost-to-serve, outflow retention

Most modern AI-native products are SaaS shells with SaS cores — a familiar interface wrapped around an autonomous service engine.

And once you see this, the conclusion is unavoidable:

SaaS metrics measure human behaviour.

SaS metrics measure output economics.

Judging SaS platforms with SaaS metrics is like diagnosing an electric drivetrain with petrol-engine tools.

You’ll get confident answers — and all of them wrong.

📉 Why the SaaS Scoreboard Fails (Metric by Metric)

1. Gross Margin: Not a Percentage — a Trajectory

Typical SaaS: 80–90%

Early AI-native: 40–60%

Not because AI-native is weak, but because:

SaaS COGS is flat

AI-native COGS scales with outputs

every action incurs compute cost

users vary massively in cost-to-serve

The correct KPI is Gross Margin Trajectory — not the static percentage.

2. CAC: High CAC + High COGS = Dead Company

When marginal costs are real, the only viable GTM is:

product-led

viral

instant value

self-serve

The correct KPI is CAC trendline vs inference efficiency, not CAC payback.

3. Retention: The Real Curve Starts at Month 3

AI-native products attract “AI tourists.”

Month-1 retention is noise.

The real signal is:

M3 → M12 Cohort Retention

Healthy curves show:

tourists out

professionals in

usage up

spend up

cohorts that dip → flatten → rise (“the smile”)

Traditional NRR hides this.

4. Engagement Metrics Are Obsolete

SaaS measures:

DAU/MAU

time in product

workflow usage

AI-native must measure:

jobs completed

workflows executed

assets produced

tasks automated

Engagement is not value. Output is value.

5. Pricing: Seats Are Dead. Outcomes Win.

SaaS pricing is cost-agnostic.

AI-native pricing must be cost-aligned:

usage

credits

outcomes

tasks

per-agent (“AI employee”)

Outcome-based pricing aligns value, cost, and margin.

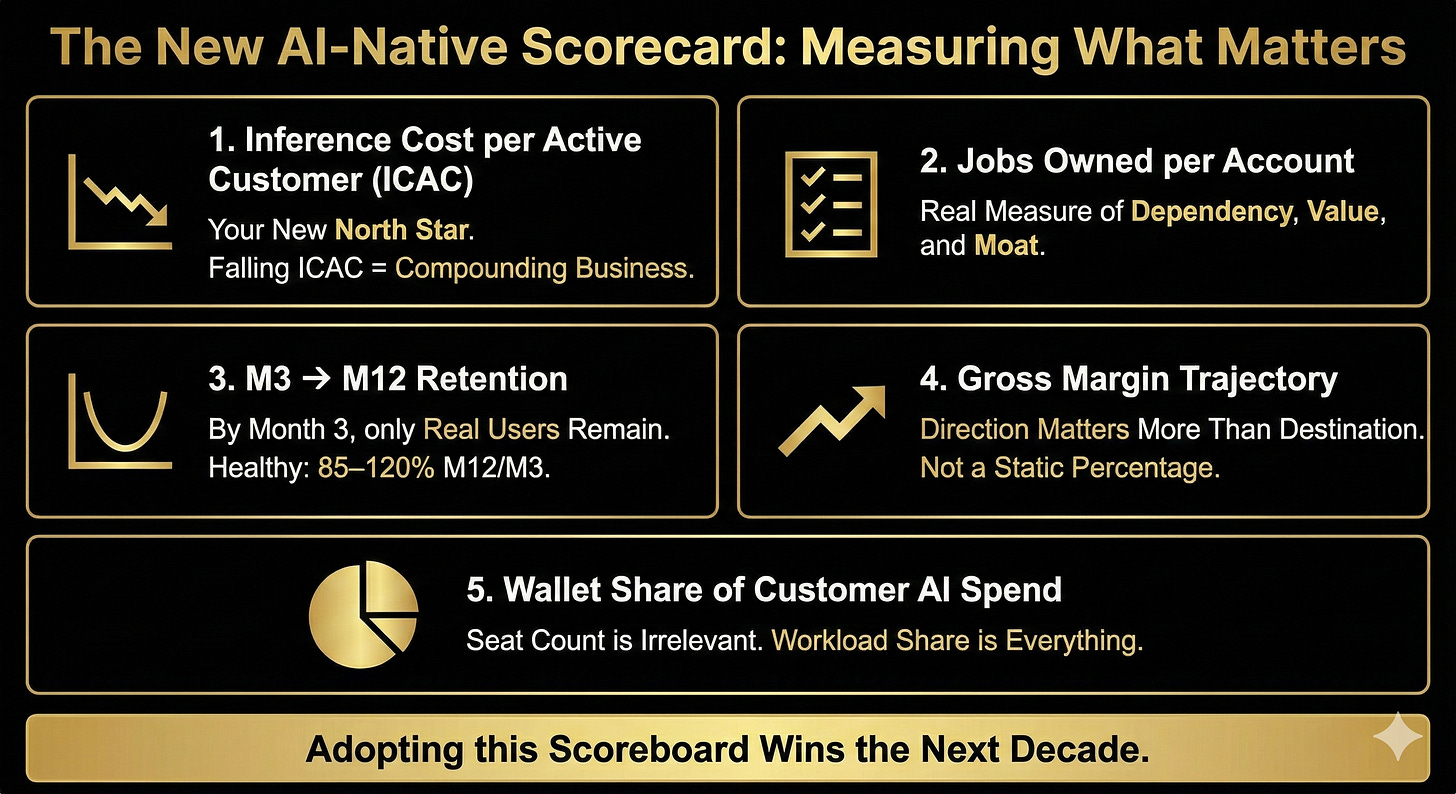

📊 The New Scoreboard: The Investor-X Scorecard

-

1. Inference Cost per Active Customer (ICAC)

Your new North Star.

Falling ICAC = compounding business.

2. Jobs Owned per Account

The real measure of dependency, value, and moat.

3. M3 → M12 Retention

By Month 3, only real users remain.

Healthy: 85–120% M12/M3.

4. Gross Margin Trajectory

Direction matters more than destination.

5. Wallet Share of Customer AI Spend

Seat count is irrelevant.

Workload share is everything.

🎯 Why This Matters

If you judge AI-native companies with SaaS metrics, you will:

underestimate growth

misread retention

misunderstand cost curves

misprice valuations

and back the wrong founders

This shift is as large as:

internet → cloud

cloud → mobile

mobile → AI-native

AI-native companies are not “SaaS with AI features.”

They are autonomous service engines delivered through SaaS interfaces.

Once the unit of value shifts from workflow → output, every metric must shift with it:

economics

pricing

retention

moats

valuation

strategy

This is why the SaaS scoreboard fails.

And it’s why those who adopt the AI-native scoreboard now will win the next decade.

Thank you for reading. If you liked it, share it with your friends, colleagues and everyone interested in the startup Investor ecosystem.

If you've got suggestions, an article, research, your tech stack, or a job listing you want featured, just let me know! I'm keen to include it in the upcoming edition.

Please let me know what you think of it, love a feedback loop 🙏🏼

🛑 Get a different job.

Subscribe below and follow me on LinkedIn or Twitter to never miss an update.

For the ❤️ of startups

✌🏼 & 💙

Derek

This piece really made me think; it’s like when you’re learning a new challenging Pilate move and realise the old ways of balancing just won't cut it anymore, highlighting exactly why your insights on new AI-native metrics are so incredibly important.