Financial Forensics: Who Survives the Correction?

Part 3 of 5: The Great AI Infrastructure Build-Out of 2025

Hundreds of billions of dollars are flowing into AI infrastructure. But who’s making smart bets and who’s headed for disaster?

Instead of just reporting what companies are doing, let’s ask the harder questions:

Which of these strategies are actually smart? Which are desperate? And who’s going to be left holding the bag when reality asserts itself?

To answer this, we need to move beyond press releases and look at the economics: capital efficiency, burn rates, paths to profitability, and what happens if the AI boom doesn’t deliver on its promises.

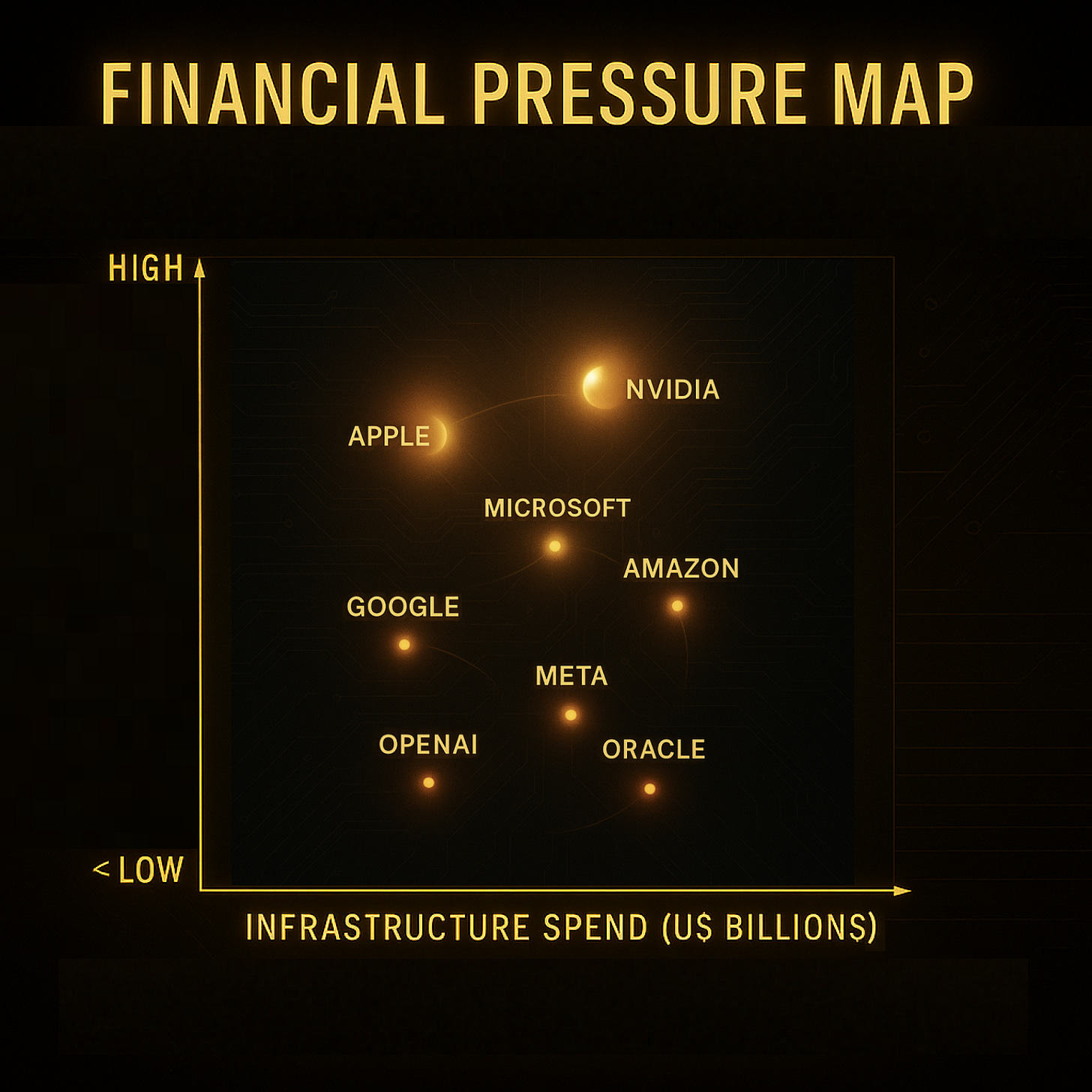

Let’s rank the major players by risk-adjusted strategic positioning — from smartest to most precarious.

📊 The Ranking Framework: How to Evaluate AI Strategies

Before we dive in, let’s establish criteria for evaluating these bets:

1️⃣ Capital Efficiency — Revenue per $ of AI infrastructure spend

2️⃣ Profitability Path — When and how they break even

3️⃣ Downside Protection — Resilience if AI demand plateaus

4️⃣ Strategic Optionality — Flexibility to pivot or hedge

5️⃣ Moat Durability — Sustainable competitive advantage

🥇 Tier 1: The Smart Money (Low Risk, High Optionality)

🛠️ NVIDIA: The Only Clear Winner

Position: Sells the picks and shovels of the AI boom. Everyone needs GPUs.

Capital Efficiency: Exceptional — $47.5 B revenue (↑217%) with ~75% margins.

Profitability: Operating margin > 50%. Already printing money.

Downside Protection: Gaming + auto + pro visualisation buffers.

Optionality: Investing across ecosystem, not locked in.

Moat: CUDA lock-in + manufacturing lead + network effects.

Risk: Antitrust or architecture disruption.

Verdict: 9/10 – Safest bet in the AI infrastructure boom.

🍎 Apple: The Smartest Move Is Not Playing

Position: Sits out the arms race entirely. No massive data centres.

Capital Efficiency: High — minimal infrastructure spend.

Profitability: 30% margins from core businesses.

Downside Protection: $162 B cash reserves.

Optionality: Maximum — can partner, buy or build later.

Moat: 2 B devices + ecosystem lock-in + brand loyalty.

Verdict: 8.5/10 – Optionality is underrated. Chess, not checkers.

🥈 Tier 2: Rational Bets with Execution Risk (Medium Risk, Clear Strategy)

🪟 Microsoft: The Fast Follower with Lock-In Risk

Position: All-in on OpenAI + Copilot integration.

Capital Efficiency: Strong — Azure AI >$10 B revenue, fast growth.

Profitability: Clear path via Copilot + enterprise adoption.

Downside Protection: $200 B core revenue can absorb losses.

Optionality: Medium — tied to OpenAI.

Moat: Enterprise lock-in + Azure scale.

Verdict: 7.5/10 – Smart bet but partner-dependent.

☁️ Amazon (AWS): The Platform Play with Latecomer Risk

Position: Neutral provider — GPUs + Trainium + multi-model access.

Capital Efficiency: Good — $90 B AWS revenue.

Profitability: 25-30% margins, AI adds high-margin workloads.

Downside Protection: Dominant cloud provider.

Optionality: High — not locked to one model.

Moat: Enterprise switching costs + operational scale.

Verdict: 7.5/10 – Solid bet, but could miss AI dominance.

🥉 Tier 3: High Risk, High Reward (Unclear Profitability, Massive Spending)

🔍 Google: The Incumbent with Existential Threat

Position: $85 B AI spend to defend search.

Capital Efficiency: Unclear — Gemini mostly free.

Profitability: Depends on ad retention vs chat disruption.

Downside Protection: Medium — still profitable, but vulnerable.

Optionality: Medium — locked into search model.

Moat: Eroding. Search dominance waning.

Verdict: 6.5/10 – Spending to defend, not grow.

🌐 Meta: The Open-Source Gambit That Might Destroy Its Own Moat

Position: Open-sourcing LLaMA while spending $14 B+ on compute.

Capital Efficiency: Poor — no direct AI revenue.

Profitability: Ad model only indirectly benefits.

Downside Protection: Medium — core apps profitable.

Optionality: Low — no cloud pivot.

Moat: Weakening — open source erodes advantage.

Verdict: 6/10 – High spend, unclear ROI.

🚀 Tier 4: The Moonshots (Extreme Risk, Unclear Profitability)

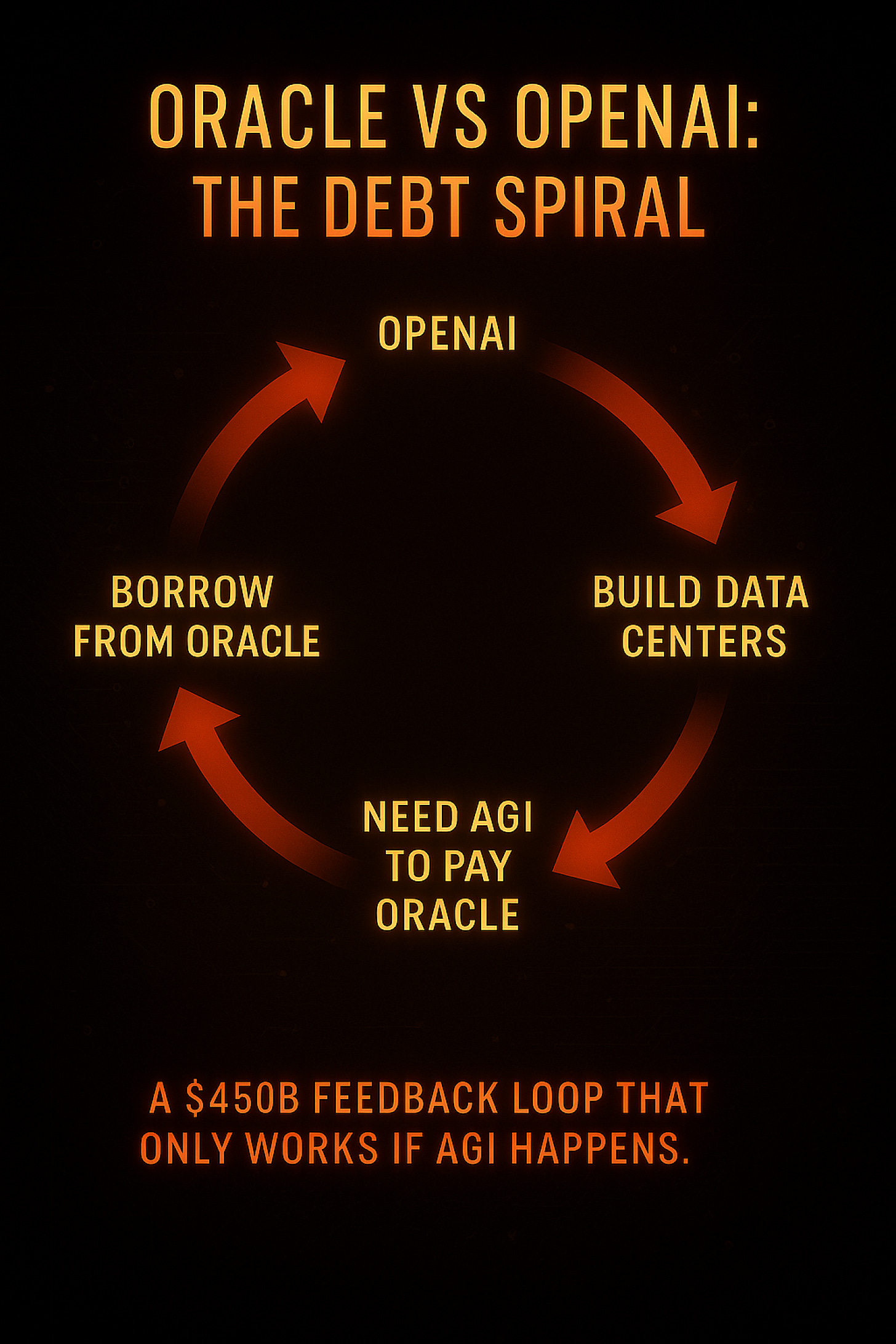

🧠 OpenAI: The $450 B Bet on AGI

Position: All-in on AGI achieved within 5 years.

Spending: $450 B across Stargate, NVIDIA, Oracle, CoreWeave.

Revenue: $5-10 B today → needs $90 B to break even.

Profitability: Entirely AGI-dependent.

Optionality: Zero. All-in on one future.

Moat: Weak vs open models.

Verdict: 4/10 – High risk, binary outcome.

🧨 Oracle: The Most Unhinged Bet in Tech

Position: $500 B Stargate + $330 B OpenAI cloud deals.

Financials: $15 B cash flow vs $16-21 B annual commitments.

Debt: $100 B needed → 40% free cash flow to service interest.

Profitability: Dependent on OpenAI paying $330 B.

Optionality: None. Fully locked in.

Moat: Weak — #4 cloud provider.

Verdict: 3/10 – 85% chance of distress by 2029. Genius or suicide.

💼 Wait — Should You Invest in Any of These?

Safe bets: NVIDIA (9/10), Apple (8.5/10) – low risk, high optionality.

Rational: Microsoft + Amazon (7.5/10) – profitable but valuation risk.

Avoid: Oracle (3/10), OpenAI (4/10), CoreWeave – moonshot exposure.

Most investors should allocate <10% to NVIDIA or Apple only.

🎛️ The Scenarios

📈 Key Variable to Watch

OpenAI revenue growth — needs $20 B+ by 2026 to justify spending.

Track: ChatGPT Plus subs, enterprise deals, API revenue.

If not > $20 B by 2026, the AGI scenario is off the table.

✅ Key Takeaways

1️⃣ NVIDIA + Apple = Smartest bets. Profit now, optionality later.

2️⃣ Microsoft + Amazon = Rational but execution-sensitive.

3️⃣ Google + Meta = Defensive spenders, unclear ROI.

4️⃣ OpenAI = Moonshot with binary outcome.

5️⃣ Oracle = Overleveraged and reckless.

Most likely scenario (50%) → Incremental progress, no AGI.

Most infrastructure spending won’t pay off.

📬 Coming Up

Thank you for reading. If you liked it, share it with your friends, colleagues and everyone interested in the startup Investor ecosystem.

If you've got suggestions, an article, research, your tech stack, or a job listing you want featured, just let me know! I'm keen to include it in the upcoming edition.

Please let me know what you think of it, love a feedback loop 🙏🏼

🛑 Get a different job.

Subscribe below and follow me on LinkedIn or Twitter to never miss an update.

For the ❤️ of startups

✌🏼 & 💙

Derek

The Oracle analysis here is brutal but probably accurate. 3/10 rating and "85% chance of distres by 2029" is pretty damning. The math is stark - $15B cash flow vs $16-21B annual commitments means they're basically underwater before they even start building the infrastructure. What really stands out is the "optionality: none" assessment. Oracle is completly locked into OpenAI's success, which is a binary bet on AGI happening within 5 years. If OpenAI can't pay that $330B, Oracle is holding massive debt-financed data centers with no backup plan. The comparison to other stratgies makes it clear Oracle took the riskiest path possible.